July'24 Networth/Life Update📉$585k (-$19k) - Uranium hammered ☢️ Guadalajara 🌮 & more internationalisation planning 🧐

Brutal two months in the markets! Uranium equities continue to get pulverised; Exploring Guadalajara; Topped up offshore positions & a consultation call with an internationalisation expert 📞

Sharing to document the financial/life journey over my 30’s, stay accountable, show that you can follow a different path to societal norms & still be 'successful', & show where I am at currently in El Mundo 🌎 ✈️ Essentially just monthly journaling but making it public!

Please Like and Share if you get any value from this ☺️

Wrote an intro on who the hell I am here if interested.

Caveats -

Write these updates as cathartic journalling - No expectations on views or opinions.

Don’t compare yourself to others. Some people reading this will be 10 years younger with 5x the networth, others 10 years my senior and for whatever reason only starting their financial journey now. It is all subjective - it’s your journey, who cares.

Only started tracking networth in 2020 (unfortunately).

Had $0 in 2016 at age 26.

I now believe that cashflow is much more important than networth - this is my new goal for the next 2/3 years; to hit $10k AUD (minimum!) per month consistently, & grow this.

Never been in debt. No kids or dependents (yet).

Left the wokeforce in June 2023 to travel and live O/S - Not had an income since (Not a digital nomad).

Wrote about my issues with ‘FIRE’ investing here.

All in AUD (the ‘Pacific Peso’ - plan to earn USD in 2025).

Certainly do not think I am rich (actually the opposite).

Saved hard, built a stock portfolio and left Australia post covid to start a new chapter (still working this out).

Financial goals for the next 2 -3 years:

1) Convert uranium stockmarket gains into online assets that yield cashflow in 2025 (location independent entrepreneurship..).

2) Start breaking tax ties with Australia.

1 - Networth Update 🪙

2 - Life Update ✈️

3 - Consultation call with Work, Wealth & Travel 📞

4 - Plans for August🧳

5 - Valuable Content Consumed This Month 🥸

Why You Should Track Your Net Worth 👈 An interesting article on the subject from another blogger - though I think cashflow is more important & will become my main focus over the next few years.

🦘 Subscribe for free to receive new posts. I post infrequently and will not spam you.

Been away for 13 months..

Just realised last week it has been 13 months since I left Australia - The longest I have been away from home before this was 12 months (I was only 19 then!). Feels like I only left 6 months ago, funny how differently we perceive time when we are constantly having new experiences/challenges….

Despite the recent market pain (discussed below), since quitting my job and hitting the road for the past 13 months, I am still up 120k+ in overall networth. I have been lucky with timing, but goes to show the power of an asymmetric portfolio, slow travelling (cut costs) & geoarbitrage (better quality of life at a discount to your home country).

Networth Update 💰 $585k(-$19K)

The chart says it all - a bloody painful two months!

Again, due to my large overexposure to uranium equities. Huge drawdown on the ASX opening today. How funny it would be if sharing this journal of my finances see’s me ride my uranium positions back to zero 😹

Have we bottomed (surely)? Elaborate on this further below 👇

Portfolio Updates

Offshore Drillers: Borr Drilling (BORR), Noble Corp (NE), Valaris Ltd (VAL) & Seadrill Ltd (SDRL) 🛢️

My buy orders were all hit this month for all four of the above offshore drillers (the ‘offshore cartel’). Despite Seadrill (starter position), these were all adding to positions I have already made ~50% on over the last two-ish years. This was with capital from Diamond Offshore and MMA Offshore, two of my best performing stocks, both of which were taken over so I reluctantly had to sell (136% & 494% respectively, talked about these in my previous networth update posts).

Would like to continue to add to these four positions further, but constraints in capital and wanting to diversify the portfolio more means I am sprinkling in slowly.

Cash 💰

At 31st July I had about 62k AUD cash ($40k USD) remaining in the portfolio. Today (1st Oct) there was another pullback in the market, so more of my buy orders for offshore got hit, & after much deliberation I pulled $30k AUD out of my brokerage & back into my bank (not reflected in the chart above).

Placing these buy orders last week to deploy this capital was difficult, given I see so much value out there at the moment in coal miners and offshore drillers. Most of these companies are;

Cheap relative to their tangible assets.

Low or no levels of debt.

Strong market fundamentals (future supply & demand).

Some of them are printing cash.

Current plan is to use this cash in Q4 to buy my first (proper) online business, in preparation for deploying capital for cashflow in 2025. $25 grand-ish should give me a starter ‘income’ of roughly $600 - $800 bucks a month (if I don’t screw it up).

A whole other topic I will discuss more in the future.

Sibanye Stillwater Ltd - SBSW ⛏️

Bought a starter position in Sibanye Stillwater Ltd (SBSW). I would like to have gone in at a 20k USD minimum, but with limited cash and so many companies I want to buy at the moment, a smaller position will have to do for now! (this idea again from Trader Ferg, so subscribe there to deep dive).

Sibanye Stillwater is a multinational mining and metals processing corporation, that is one of the world's largest primary producers of platinum, palladium, and rhodium, and is also a top-tier gold producer. It has also established itself as one of the foremost global PGM auto catalytic recyclers (bullish ICE vehicles).

This polymetallic miner is part of the play on ‘the PGM trade’, which simplified boils down to ICE (traditional internal combustion engines) & Hybrid vehicles being dominant in the medium/long term future, while bearish on electric vehicles.

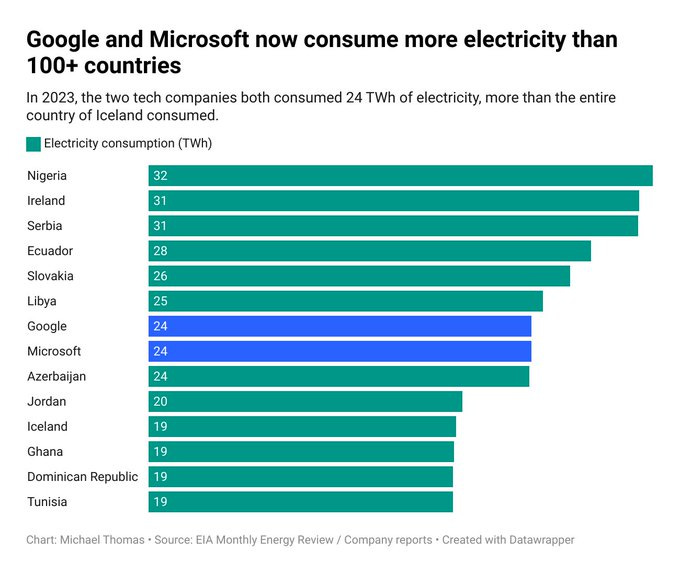

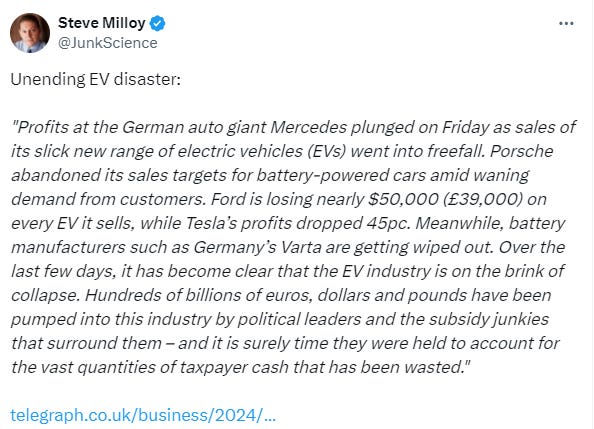

This is a whole contrarian topic in and of itself, but electric vehicle sales are struggling globally, held up mostly by government mandates and subsidies.

Once you deep dive the physics behind EV’s, it seems impossible for them to gain any kind of significant market share without huge ongoing government subsidies. Some of the most obvious and pertinent issues with EV’s (that no-one mainstream talks about) are:

Breakeven mileage vs CO2 emitted to create a vehicle (EROI). Most EV’s have to be driven over 300,000 miles to break even on the CO2 emitted that was required to create them, accounting for the entire energy chain, mining all the materials etc; for a hybrid, it is typically less than half this.

Range anxiety, particularly in countries like Canada, Australia & the USA.

Costly charging infrastructure - Exactly the same problem as wind and solar, we don’t have the grid infrastructure to support them.

Toxic battery waste - most countries just currently send batteries to landfill with no thought of all the toxic elements in the battery. Imagine the wall of used batteries ready for the tip coming at us in the next 5 to 10 years…

(Just some more of my tin-foil theories I guess 😌)

The below article does a great deep-dive on how much money Ford has been haemorrhaging through its EV program 👇USD $64k per vehicle! (you won’t hear this on the MSM).

Anyway, along with PGM’s for ICE vehicles, Sibanye Stillwater also has gold and some uranium assets in its portfolio, both of which I am bullish on over the next few years, so this is a nice diversification to the portfolio (gold, not uranium of which I am hugely overexposed given the chart at the start).

Biggest risk with SBSW is that the majority of its assets are in South Africa, which is somewhat of a basket case politically at the moment (not to mention how badly they fked up their energy grid).

Could write a whole post on this but I’ll leave it there, DYOR if interested.

Uranium ☢️

(Sick of talking about it 😅) Portfolio continues to get hammered as uranium equities tank - full transparency here!

The exact same things apply as I mentioned in my last update, & I’m not planning on selling any uranium shares until Q1 2025.

Quick pause for a self-justification pep talk, to myself ….

At the end of the day, what is end goal for my capital invested in uranium equities?

Answer = To invest 80%+ of it in my own location independent, cash-producing, semi-passive businesses, starting in 2025. If I had to liquidate all the positions today, I would still have about 300 grand to invest in starting my own business, which given the average profit multiple of a good website being 3x (# of years to reach 100% ROI), 300 grand would yield an average monthly cashflow of about $10 grand per month (a LOT more than 1 million in passive ETFs yields per month).

So at the end of the day, this is why I am not worried. It is more a feeling of ‘disappointment’, even though I know things will change a lot in the next 6 months within the uranium market. Ahh, I feel better now 🙂

Funny how similar my own networth chart above looks compared to the yellow line below… 👇

Just as last month, The Pale Blue Dot Substack succinctly sums up the recent pain felt by uranium investors far better than I could. 👇

My biggest personal take home from the above summary

“I detect some impatience in uranium investors, and I do understand how very frustrating this business is... especially if you have a lot riding on it. One of my key principles is not spending all my days looking at share prices. (guilty..) There are much better things to do with my time. I know that is not easy. In my younger investing days, I did that. Now I know that it does not matter. Stock prices will respond soon enough. The key things to look for in uranium are whether the fundamentals will cause prices to go up or down and what black swan events are out there that could derail it either way.

All major industrial nations are flocking to nuclear power, and that ultimately translates into more uranium demand. It will not occur tomorrow , but it will occur. And that is where the frustration is... we don't quite know when.”

You must have patience. Without it, uranium will drive you nuts.” (it already is 😅) - .

What is ‘funny’ about the uranium market at the moment is that equities are still tanking despite fundamentals stronger than ever!

Kazakhstan's tax increase and the UAE's nuclear expansion plans collectively contribute to a bullish outlook for uranium, highlighting the sector's resilience and growth potential amidst evolving global energy dynamics and geopolitical considerations. -

Nam Cheong Ltd - 1MZ ⚓(on the SGX - Singapore Stock Exchange)

Really want to get a position in 1MZ, after reading a comprehensive write-up from

, followed up by more research from and some of his Substack subscribers. I won’t repeat Fergs detailed paywalled content here, but the trade reminds me somewhat of MMA Offshore, of which I (almost) made a 6x bagger earlier this year.The share price is running, but I am hopeful for a pullback to at least 0.20. I now have very limited cash after pulling out my last 30 grand AND after being too greedy today (1st) in buying more offshore drillers in the pullback. Think I will sell my position in Peabody (BTU), and try redeploy into 1MZ..

2 - Life Update ✈️

Guadalajara

I’ve spent most of July in Guadalajara, Mexico (GDL). My gf works in the film industry & she was meant to be working on a project here until September.

She won’t let me say who, but a big Oscar winning actor, the lead on this project (give you a hint, he played the emperor of France in a recent movie..👀), cancelled the movie only 2 months in after he knocked up his missus (😅), leaving everyone working on the project with just 2 weeks to pack everything up (I didn’t realise how crazy the logistics of making a hollywood movie are).

Apparently it is quite common for Hollywood to outsource much of the production of movies to Mexico, to help cut down on costs.

I really like it here (prefer it to Mexico City - CDMX, though I still like CDMX!). Like any Latin American (or any) city, it has its shitty, dangerous parts, but the nicer middle class areas (generally in the central, north-western part of the city) are super nice, safe, have better infrastructure than CDMX & also great food, both street food and fine dining.

Within about a 12 minute walk from our airbnb in Providencia, we had everything from Korean BBQ, Bratwurst, Italian, wine bars, Australian quality cafes etc.

Would definitely recommend GDL for more of a ‘digital nomad’ type, who wanted to bunker down in a city for a few months and get into a good routine. I have found the gyms here to be great (cheap), and the people (Tapatios) super friendly and patient with my shitty Spanish.

Bit of a generalisation, but the population of GDL has slightly more of a Spanish/French ethnic heritage compared to CDMX and other parts of Central/Southern Mexico, and therefore people tend to be taller and more European looking in general. Tequila & Mariachi are also both originally from Jalisco (the state).

Guadalajara has everything you could want from any modern city, while not being quite as hectic as CDMX (though traffic is still shite). As usual if you have a ‘middle class’ Australian/USA level of wealth here, you live an exceptional quality of life at a much lower cost (geoarbitrage). Parts of Mexico are definitely becoming more expensive however relative to the rest of Latin America, as its economy continues to strengthen.

While GDL city itself doesn’t have a heap of tourist attractions; there are lots of towns in Jalisco that are great to visit on weekend trips away from GDL, such as nearby Tequila (the town) or Lake Chapala, where we went for the weekend. Sayulita (for great surfing) is about a four hour drive to the west, along with Puerto Vallarta (more for retirees).

Tlaqueparque

Tlaquepaque (still can’t pronounce it properly - half of the names of places in central Mexico are in Nahuatl, the original indigenous Aztec language) is a barrio of GDL that used to be a separate Spanish colonial town, that was swallowed up by the city as it grew. We did a daytrip here as it is famous for artisanal stuff, local produce, amazing food & of course, tequila.

Great place for a daytrip if you’re into arty stuff, or looking for somewhere to take your gf. Had some of the best tacos of my life here.

Ajijic

Lastly, did a weekend trip to Ajijic (‘Ah-he-hic’) to get out of GDL. Ajijic is a little town on Lake Chapala, the biggest lake in Mexico, about 1 hour south of GDL. It is full of Canadian and US retirees, covered in murals and full of local artisanal stores.

This was waking up in our airbnb 👆 jungle in the background

One day I took us on what I thought was a 3 hour ‘quick hike before lunch’, which turned into a seven hour ordeal where we almost got stuck in the jungle on a small mountain, and then were also caught in an massive storm - I certainly fked up on this one 🙂.

3 - Consultation call with Nicole from Work, Wealth & Travel 📞

Had a great chat with Nicole, who runs her internationalisation business, Work, Wealth & Travel. There are a lot of people offering their services in this space now, and it is difficult to know who to go with. Not sure what to expect, but Nicole seems professional and knowledgeable, so I’ll keep writing about my experiences and let any readers in a similar position know my experience.

Internationalisation planning is daunting for an Aussie, especially offshore corporation formation (I still only understand the basics, will learn by taking action).

Broad goals, next 3/4 years - Create a '5 flag' internationalised life.

Try to legally escape the Australian tax system over the next few years.

Diversify banking with multiple overseas accounts.

Setup a business in an offshore corporation (once I actually start one).

Setup an Interactive Brokers Account in the USA (or similar) as a non US citizen

Acquire at least three international residencies, starting with Paraguay and Mexico ASAP (then potentially Panama).

Main points from the call

Paraguay Residency - Plan is to head back into South America in October, and get this residency done. If nothing else this is a great ‘Plan B’ option, and potentially will help me with tax optimisation in the future.

“Paraguay residency is a low hanging fruit option for residency currently, it is a good play to obtain in your residency portfolio now” - Nicole.

Apparently there is a 4+ month backlog on Paraguayan residency paperwork at the moment, given the sheer number of applications from Western Europe and North America. I imagine there will be a spike in demand after the US election (no matter who wins)!

Setup a US LLC Corporation - This is pretty standard for many people structuring their offshore businesses. The US does NOT tax you if you are not a US citizen, but with a US incorporated company you get access to the US banking system, and it also adds a layer of personal financial protection for you (for example you can not be sued or go bankrupt, the company does).

There is a lot of filing paperwork that goes with this, that Nicole’s team handles for you as part of the service. I can’t open any US bank accounts until this is setup, so I will hopefully look at doing this before years end.

Panama company formation - I had not planned this at all, but it could potentially be a good way to structure an offshore business portfolio, particularly if you want an offshore brokerage account. I think it cost $10k USD upfront, but this includes formation of your own company, Panamanian bank accounts (good banking), AND temporary residency, which after 2 years you can upgrade to permanent residency (which you then have forever). Seems like a pretty good deal and something I will consider over the next few weeks.

Mexican Residency - Spoke about this last month. Need to apply for this at the Mexican Consulate in Australia (early next year). Hopefully I can skip TR and go straight to PR.

Georgian Bank Account - I completely forgot to ask her about this, but will follow up soon. You can open these accounts up remotely still (I think), though I believe it costs a few grand. Georgian banking is strong, and often recommended by Andrew Henderson, The Nomad Capitalist.

Excited to keep talking about my progress with all this in the coming months. Achieving the goals outlined above will be a long, multi-year process, but it feels good to have taken the first small step.

4 - Plans for August🧳

A few more days in GDL, then I’m gonna head to Zihuatanejo (Zee-wan-ten-ek-o 😅) on the Pacific Coast for a week. There is a nearby beach town called Troncones which is known for its longboarding, so hopefully I might get a wave in here 🏄♂️.

Then it will be back to CDMX. I’ll probably park-up in Cuernavaca (2 hours south of CDMX) while my gf looks for more work (jobs in the film industry are sporadic based on projects). Her family has a epic old mansion/holiday home there that we can chill in by ourselves.

5 - Interesting Content Consumed This Month 🥸

Recently discovered Substack page.

For a guy like me who (oddly) nerds out on all things energy, it is a great read. The below piece on Nuclear Energy is a must-read/share - particularly if you have any ‘on the fence’ friends who don’t really understand the physics behind nuclear and why it is the best/cheapest form of energy (by far). This piece would do well to be mandatory reading by all my fellow Australians given the current political ‘debate’.. 🤦♂️

& Andy interview - Commodities Are Too Cheap to Not Be All-in on the Sector Right Now

SO much gold in this interview. Aligns broadly with my views on global macro and investing as a whole.

Hidden Costs of Home Ownership in the USA 🦅 - Substack

In the below piece 👇 I briefly ranted about the obsession of Australians with property ownership as a vehicle of financial success, and how I think this is not necessarily the best idea for everyone (while you’re young, no kids etc).

This article - Study: Typical single-family home costs over USD $18,000 per year in hidden expenses; outlines the financial insanity of investing in a home in the land of the free. I would hazard a guess these costs would be even more inflated in Canada or Australia.

If your parents are asking you when you’re going to settle down and buy a house, you might want to send them this article on how much it really costs to own a home.

When you add in insurance, taxes, maintenance, and repairs, the average U.S. homeowner with an average house is paying an extra $18,118 every year on top of their hefty mortgage. (It’s much higher in states like California.)

You could probably pay for a year’s worth of Airbnb monthly rentals in much of the world on that amount alone (Exactly what I have been doing the last 13 months ☺️).

Confirming my investing biases

The quote below from the

Substack completely aligns with my way of broader thinking on energy and investing. This is a great Substack, & I am not sure why it doesn’t have more traction (give him a follow!).Whether it’s oil, copper, uranium etc. our commodity supply chains are strained from decades of neglect and underinvestment. Today, the mining and resource sector suffers not only from a lack of institutional investment interest, but also the brain drain of human / intellectual capital, as young people continue to flock towards the tech sector in search of the most lucrative jobs.

The energy sector’s weighting in the S&P500 is currently <5%, while contributing to ~10% of the index’s earnings, and offering the highest buyback and dividend yields. The entire uranium sector, which fuels 10% of the world’s power generation, and 25% of the world’s low-carbon electricity, is currently valued at <$150bn. That’s less than the market cap of some software companies like Adobe or Salesforce.

The world’s major copper producers are continuing to spend almost no capex on growth and exploration, despite depleting ore grades and massive cost inflation. The largest copper mines are struggling to maintain production. - Saad Khan

Mexican Facts 🫔

Super interesting read from the Substack (a great subscription) about Mexico. Thoroughly enjoyed reading these given my current plans to set up a base here in the future.

Optionality in Life

The below block quote from resonated with me; in terms of having liquid assets (stocks), no debt (no housing ponzi at a young age), & optionality to travel (not working for someone else/having a boss). I have said before that I am the odd one out here, and this appeals to me at this stage of my life.

Choices can be agonizing, but it is better to have agonizing choices than to have no choices at all. It is generally understood that optionality in life is a good thing, and that we should strive to increase it.

We can increase our optionality by getting an education, staying out of debt, having a variety of skills, or any number of other choices.

When one has options, one can limit the downside if things in life don’t go as planned, with the potential for great upside if they swing in one’s favor.

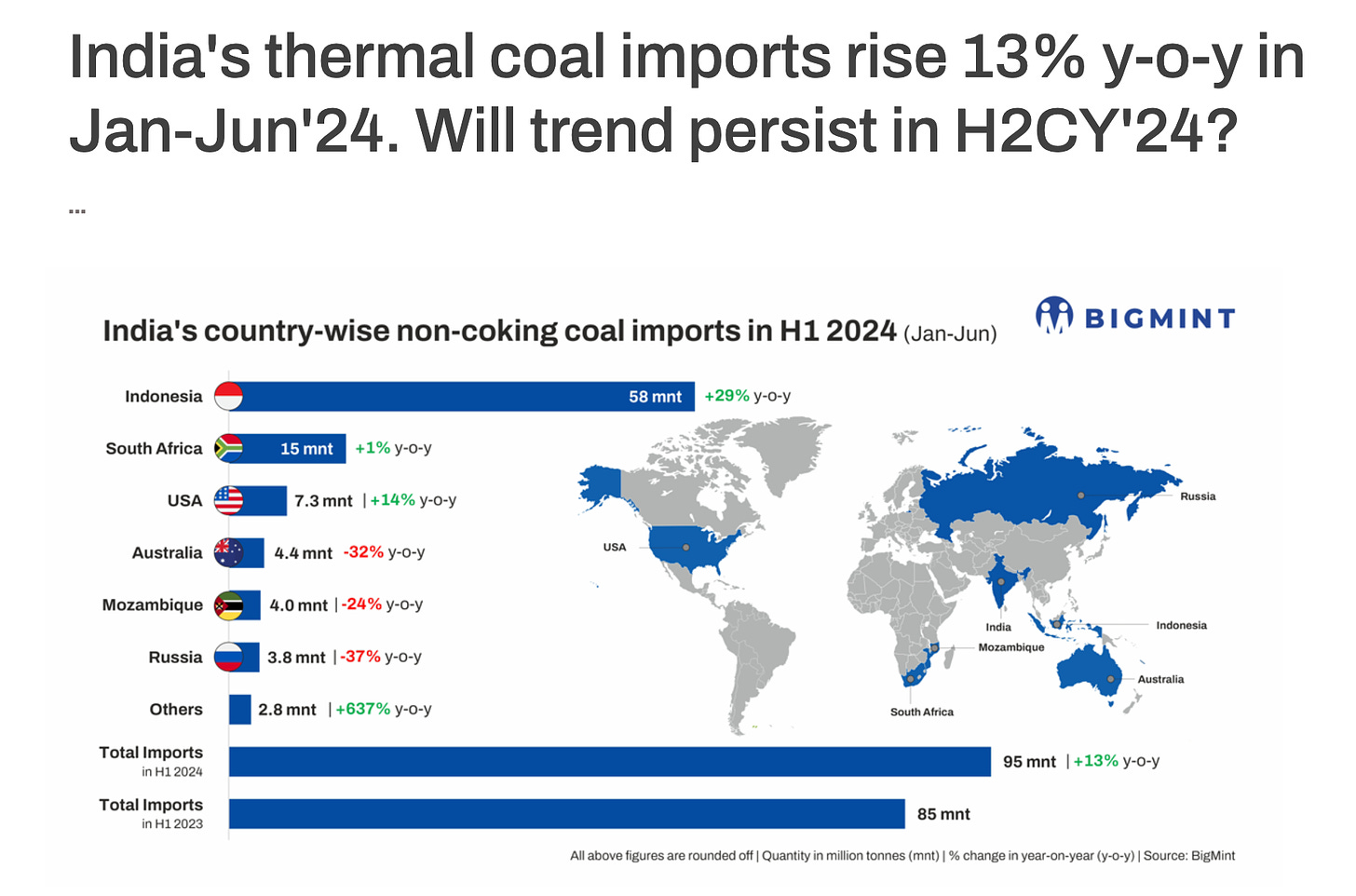

Got Coal?

In June this year, Chinese coal production surged to its highest level in six months, reaching 405.4 million metric tons, a 3.6% increase compared to the same month last year, as reported by Reuters based on data from China’s National Bureau of Statistics.

Got Energy..? ⚡

Reading some of the headlines back home, I often feel better about leaving

Yes, I am being somewhat ‘tongue in cheek’ here, and yes, The Spectator is a ‘Centre Right’ media outlet (one of the few), but I struggle to read much else from the MSM these days without 🤢 🤬

How low Australia has fallen… Spectator Australia.

Our once-great BHP now has a ‘Vice President for Sustainability and Climate Change’ - a made-up ESG job that provides zero value 🦟 though I think we may have reached ‘peak ESG’...

The number of Australian students choosing physics at high school is collapsing - sad to see as a science graduate myself. This must be somewhat correlated with that generation’s religious adherence to the climatic catastrophe narrative?

Our government opposes nuclear energy while pretending we can build and operate nuclear submarines - Clownworld..

….

Nuclear power will eventually win out in Australia, as the physics behind solar and wind continue to push up power prices - the question is; how many years of pain does the Australian public have to endure, and how many billions of (my) taxpayer dollars will have to be wasted pursuing a virtue-signalling climate policy…

I am 34yrs old, and am hopeful to see nuclear power in my home country in my lifetime!

Brief thoughts on the UK election - better summed up by in his piece, ‘Electing Poverty’.

..the decades-long decline of the UK from global power to geopolitical afterthought can be modelled quite reliably through the lens of the physics of energy.

With the recent publication of the 2024 Statistical Review of World Energy, the story of Britain’s relentless demise is available for observation by anybody with rudimentary spreadsheet charting skills. Starmer’s plans, combined with his undoubtedly temporary but near-dictatorial powers, look set to complete the UK’s final descent into economic oblivion.

The UK is likely headed the way of Germany over the next five years, & unfortunately I don’t think Australia is too far behind as we pursue our current energy policy.

Went down a small rabbit-hole on Climate Change… 💣

It’s tin-foil hat and personal view/rant on things time.

I share a lot of content that argues the contrary to the Climate Catastrophe argument - if this doesn’t jive with your own beliefs to a level where you feel personally insulted, then skip this bit 😊 but I find the matter fascinating! (science is never ‘settled’..)

(it has recently come to my attention, after some unhinged personal comments that ‘disagreed’ with some of my views on things, just how offended people can get when you share a point of view that differs from the mainstream narrative.. 😅 if you don’t like it, don’t read it - who cares what some random Aussie ex-geo in Mexico thinks?).

About 12-14 years ago as a young geology student, even I was on board with the typical argument you see at the end of a Netflix David Attenborough documentary, espousing that we will all be doomed to famine and floods in 50 years unless we cease all CO2 exhumation immediately. On the face of it, the greenhouse argument seemed pretty simple, and made sense. But, after a decade of coming to my own conclusions (based on facts and data) I have almost done a 180 on my initial views!

Essentially yes, I still think that human-induced exhumation of ‘greenhouse gasses’ may well lead to a small amount of latent atmospheric warming over the next 100 years, but I don’t think this will have many (any?) of the catastrophic effects that we are constantly told they will have by the elites/politicians. In fact, I think some of the effects may likely be a net-positive to our environment (CO2 is plant food after all, and the world has actually been greening over the past three decades if you look at the data..).

Importantly (for me at least) there are FAR BIGGER problems in the world; Personally, these would be, poverty in Africa (people need cheap energy) and plastic pollution & overfishing in our oceans (making people richer through cheap energy is the most efficient way to lower levels of pollution…).

It is crazy to me that a narrative of potential future climatic catastrophe could be rank-ordered as a higher priority problem than helping fellow poverty-stricken human-beings or trying to mitigate our pollution of the world’s oceans.. You always have to choose what % of one dollar will be used for a specific problem, and I think if we worked on the two mentioned above as a matter of urgency this would have an extremely higher net benefit on both our planet and our species than trillions spent on ‘renewable’ energy does (it’s not renewable, you have to mine the materials to build them).

Anyway, on this topic, another interesting read below if this sort of thing floats your boat (sea-level rise pun?).

And continuing with this theme… 🐇🐇

My fellow Aussies can breathe a collective sigh of relief RE the Great Barrier Reef (check the sources)! I remember this was another Netflix documentary about 6 years ago on how the reef was 50%+ bleached beyond repair….

This comes from Bjorn Lomborg’s work, who is an absolute must follow if you’re interested in anything climate-change related. No doubt the reef has many other human-induced issues to deal with in the future, but at least this trend is reversing.

Ending on another final positive note ☢️

I hope Australia’s countryside looks like this one day 👆

And not like this 👇

Rant over!

That’s all for July - Appreciate it if you made it this far!

Hit the ♡ button & subscribe/share.

Cheers ! 🍻

Tom - Van Diemen 🦘

Thanks for the shout!

Appreciate the diversity of content and your candidness in sharing the ups & downs. There's also nice nostalgia/escapism reading about your life, as I roamed Latin America for months at a time when I was a seasonal wildland firefighter 10+ years ago.

Being a nomad is not easy but it sure is wonderful. After a number of years, I happily traded that for a family and am thrilled to be building towards extended travel abroad with them - perhaps the best version of being a nomad, in my own view.

Keep living the dream, and keep up the good work!