June '24 Networth/Life Update📉$604k (-$75k) - Portfolio Tanking🫣Climbed a 6,000m Peak 🗻 Went to Cusco 🦙 Flew Back to Mexico 🌮 Adopted a Street Cat.. 😼 Internationalisation Planning 🤔

Portfolio tanked this month! Time to go back to the rig in Australia? 👀 📉 I climbed a (big) mountain in The Andes 🏔️ Visited Cusco ⛪ flew back to Mexico 🌯 & Discuss Internationalisation Plans ✈️

Sharing these updates to show the financial journey over my 30’s, stay accountable, prove that you don't need to follow societal norms to be financially 'successful', & show where I am at currently in El Mundo 🌎 ✈️

Wrote an intro on who the hell I am here if interested.

Caveats -

Write these updates as a form of cathartic journaling - Zero expectations on views or opinions.

Don’t compare yourself to me. Some people reading this will be 10 years younger with 5x the networth, others 10 years my senior and for whatever reason only starting their financial journey now. It is all subjective - it’s your journey, who cares.

Only started tracking my networth in 2020 (unfortunately).

Had $0 in 2016 at age 26.

Never been in debt. No kids or dependents (yet).

Left the wokeforce in June 2023 to travel and live O/S - Not had an income since (Not a digital nomad).

Wrote about my issues with ‘FIRE’ investing here.

All in AUD (the ‘Pacific Peso’ - plan to earn USD in 2025).

I do not think I am rich (actually, the opposite!).

Saved hard, built a stock portfolio and left Australia post covid to start a new chapter (still working this out).

Financial goals for the next 2 -3 years:

1) Convert uranium stockmarket gains into online assets that yield cashflow (entrepreneurship..).

2) Start breaking tax ties with Australia.

1 - Networth Update 🪙

2 - Internationalisation Planning 🌎

3 - Life Update ✈️

4 - Plans for July 🧳

5 - Valuable Content Consumed This Month 🥸

Why You Should Track Your Net Worth 👈 An interesting article on the subject from another blogger - though I think cashflow is more important & will become my main focus over the next few years.

Networth Update 💰 $604k (-$75K)

Down $116k AUD since the end of May highs.

Yep, not a typo - Biggest monthly drawdown on my portfolio since I started investing 😮😅 Mostly due to huge pullback in uranium (of which I am overexposed).

Am I worried? Nope! More on the uranium pullback below 👇

Volatility is painful - But remember, volatility is the price you pay for outperformance (famous last words).

I talked about investing in asymmetrical sectors here; and mentioned how this style of investing in not conducive to the psychology of 80% of people (who are probably better in passive, semi-passive).

Boy has June 2024 tested my psychology 😅 Down over 100k in about five weeks (I know others in the uranium space that have had seven figure drawdowns in the past month..).

Sold my position in Diamond Offshore for a 136% gain; After the company was taken over by Noble Corp

Noble and Diamond Offshore Announce Merger Plans

136% in just under 2 years - better than a hole in the head. Another Trader Ferg recommendation (Also recently made 494% off MMA, an OSV company he recommended only 2 years ago). See How I Invest where I talk about who I follow for my investing philosophy.

I have also owned Noble Corp (NE) since about 2021. Cash from the sale of Diamond will be used to top-up positions in additional Offshore Drillers (3 to 7 year time horizon).

Topped up position in RIG (Transocean)

Added to my position in Transocean with cash from MMA Offshore. With the takeovers of Diamond Offshore & MMA Offshore, the offshore driller portion of the portfolio now looks like (with a few more new positions soon):

RIG (US) - Transocean: Largest position - Boosted this month.

BORR (US) - Borr Drilling Ltd: Plans to sprinkle more capital on a price dip.

NE (US) - Noble Corporation: Plans to sprinkle more capital on a price dip.

VAL (US) - Valaris Ltd: Plans to sprinkle more capital on a price dip.

Uranium stocks tanked in June 😥 Back to the drill-rig in Australia next year..?

BIG correction in uranium for the end of the Aussie financial year.. 🎢 Time to strap in as volatility ramps up. This is what happens when 65%+ of your portfolio is locked up into one sector… 😆

.

An important point for anyone new to investing the the ☢️ market..

The Spot Uranium market is not a true commodity market. There is no public trading of U3O8.

There is so little material on offer that there can be large price swings as macro and sector-specific sentiment and trends influence the negotiations between buyers and sellers.

There are also Uranium traders who have signed long-term offtake contracts with a small number of producers. They take small deliveries on a regular basis that they need to sell into the Spot market to provide cash flow to keep their business afloat. Every buyer in the tiny Spot market knows this and tries to use that to achieve the pricing they desire on their orders. It's a small illiquid market.🏜

Price volatility is the result.🎢 - John Quakes.

The old saying; ‘The market can stay irrational for longer that you can stay solvent’ has certainly been ringing in my ears this month. Again this is what I have to weather being so over-exposed to uranium miners in the portfolio.

Am I concerned? No.

The plan has always been to not start selling ☢️ until 2025, so all this volatility is just short-term noise. Bullish fundamentals on the whole energy/uranium thesis have never been stronger. Quick recap 👇

Super thinly-traded, illiquid market (upside volatility can be just as extreme).

The supply side of U308 is not being fixed.

Demand for ☢️ keeps grinding even higher.

Similar (negative) sentiment across the whole energy space this month (coal, offshore etc).

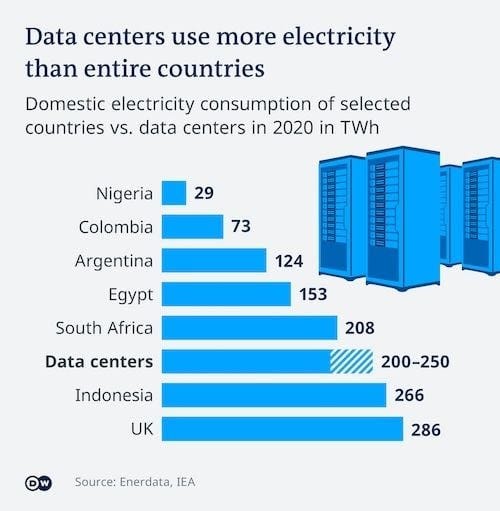

Additionally, the original uranium thesis never factored in demand, only limited supply of U308. The new touted boom in AI is yet more bullish news, given the energy demand of data centres that will only be able to be provided by baseload power (not ‘rebuildables’).

Hopefully the networth chart looks a bit healthier next month..! Perhaps all of the above is me in my own echo chamber/self pep-talk, trying to maintain conviction in my portfolio.. 😅

2 - Internationalisation Planning 🌎

Documents apostilled for Paraguayan Residency

Will talk about this more in the near-future. My Dad back in Australia managed to get the necessary documents apostilled for me (cost over $450 all up.. Forget how ridiculously expensive everything is back in Aus sometimes..).

Why Paraguay? Why Internationalisation?

I could write a 10k word essay on this; but to summarise, I’m essentially looking at slowly building out a portfolio of international residencies over the next ten years, to diversify myself away from Australia and ‘The West’.

If you’re not familiar with International Flag Theory < < check it out. This is essentially what I would like to try to emulate over the next decade.

I won’t go into a Covid rant here, but being locked inside my own country (actually almost 3 years locked within a state of my own country) and being unable to leave was a big wakeup call for me.

I want to have more options and invest in countries that are slowly becoming better economically, and will continue to get better over my lifetime (and are more free). I truly believe The West is in a state of slow decline, both economically and culturally. Australia is certainly nowhere near as bad as Canada, the UK or parts of the USA or Europe, but the trajectory is not looking good.

Probably just lost a bunch of readers who now think I’m a tin foil hatter 😜

Paraguay is an easy first residency to obtain, with basically zero physical presence required in the country (after you get it), and with many options for tax optimisation if you run your own business (Paraguay has 0% tax on foreign income).

Current vague plans are to meet up with Jordan 🇦🇺 in September in Asuncion, Paraguay and (hopefully) get the Temporary Residency all sorted. I’ll aim to get the Paraguayan Cedula card & and RUC tax documentation while I am there too.

This is the first small step in my internationalisation plans. Over the next 12-months the next steps are (in no real particular order):

Obtain Paraguayan Temporary Residency (September) - Basically the easiest residency in the world to get (for now). I want to get this for a nice ‘Plan B’ country (to have up my sleeve) and also to help me with tax optimisation in the future. Can apply for Permanent Residency after 2 years.

Open a US-LLC corporation - I don’t have a ‘business’ yet but plan to be buying websites/online businesses with my stock portfolio gains over the next few years, for cashflow. Part of the purpose of this LLC will be to.. 👇

Aim to legally leave the Australian Taxation System - This is a lot more complicated for an Australian that has assets than many (on Twitter) would have you believe, but it is possible given enough time and if done correctly.

Open up some offshore bank accounts - Once you have the US-LLC you gain access to the US banking system, which is bloody incredible (US credit cards have epic airline points rewards).

In addition to this I would like to open an account in Georgia (the country, you can do this remotely) & potentially Uruguay a bit further down the road, once I get some cashflow (Uruguay is top-tier banking, but expensive).

Apply for Mexican Residency - Another low-hanging fruit no brainer (IMO). I bloody love Mexico (my gf is Mexican), and I am super bullish on the country over the next 10 to 20+ years, as the USA pivots away from China and instead to Mexico for the majority of its trade & manufacturing (plus Mexico has a lot of offshore O&G in The Gulf).

Unfortunately I can only apply for the residency in Canberra (Australian Capital). I’ll be aiming to do this in January next year, when I’ll be home for a few months. Once you have the Mexican residency, you have it forever, and after about five years you can apply for citizenship/passport, which is a great deal (MXN passport is a strong one, but my Spanish needs a lot more work before then..).

Video below is a bit of a oversimplification on Mexico’s rise economically, but exemplifies my point.

3 - Life Update ✈️

First week of June I was still in Arequipa, Peru. As I described last month, I had come to Peru with my mate

specifically to embark on a bunch of big hikes in the country, but was unable to (mostly, we still did do a few smaller ones) as we were both sick as dogs for most of our time in Peru, after surfing in dirty Lima water 🏄♂️.However, in the last few days of my time in Arequipa, I decided to swallow a concrete pill and have a crack a climbing Mount Chachani, the highest of the three volcanoes that dominate the eastern skyline of Arequipa at 6,075m.

This was a 2D, 1N trek, and allegedly one of the easiest 6000m peaks to climb in the world (though I think this is a marketing ploy..). I went with Quechua Explorer (no affiliation), they were super professional and well priced (cheap), would recommend.

Day 1 - you only hike for about one hour, & only about 200m vertical elevation, to get to basecamp. Dinner is at 4pm, before ‘breakfast’ at 12.30am, and starting the hike at 1am.

Day 2 - It was a bloody slog given that I was still not quite 100% over the virus I’d picked up in Lima, and that I had not managed to fall asleep even after taking 6mg of melatonin. Basically just lean heavily on your trekking poles while struggling to breathe the thin air, concentrating on the light from your headtorch.

A British bloke on our trek bought a small UE Boom speaker, strapped onto his pack (thankfully he had great taste in music, mostly 90’s grunge like Soundgarden) so that was a welcome distraction!

The sun started to rise about 1 hour off reaching the summit.

The climate here still blows my mind; ~6,000m above sea-level and almost no snow, extreme UV due to the altitude, -10 degrees Celsius at night but hot during the day, given proximity to the equator. Growing up at sea-level in Tasmania, I once recall it snowing on the beach (though this is not common), and here I was at 6,000m with only a teeny bit of snow (high-altitude desert) but still well below freezing.

Made the summit at around 6.30am. A relief to finally stop, and suck down some oxygen. Taking photos was difficult given you had to take your gloves off, the windchill would have been below -5 celsius.

I was pretty stoked to actually achieve something, after failing to hike the infamous Huayhash trek in Northern Peru earlier in the month - talked about this here.

After two weeks in Arequipa - My mate

went back to his new adopted home in Buenos Aires 🧉 while my next stop was Cusco 🦙

After a big shakeup in my travel plans for SudAmerica, I only had 1 week in Cusco, before planning to head back north to Mexico 🤠.

Cusco is the #1 destination in Peru for tourism (with good reason), and there is a sh*tload of things to do. But honestly, I just wanted to chill out for six days and not do all the typical touristy things - I am a lazy (long-term) traveller these days, especially when I am alone, & more content to just chill and get into a routine.

I certainly had zero interest in the typical Aussie backpacker ‘find yourself’ ayahuasca ceremony experience, though perhaps in another circumstance (went through a bit of a mushroom phase during covid… 🍄😆).

4 - Plans for July 🧳🌯

I am currently in CDMX for one more week until about the 6th of July; after that I’ll be in Guadalajara for four/six weeks (July/August); & in August probably head to either Baja or Oaxaca.

If by chance anyone reading this wants to catch-up for a 🍻 feel free to reach out!

I flew back to Mexico on the 12th of June 🌮 Future plans to (hopefully) put down some roots in Mexico 😊

Currently back in Mexico City (my gf lives/works here); interestingly the Mexican Peso (somewhat) tanked after the recent election of the new quasi-socialist president (though it has recovered quite a bit since), meaning that things aren’t quite as expensive as they were in December (when I was last here).

We also briefly adopted a street cat… 🐈

My gf decided to rescue a stray on her morning walk to work (near Chapultepec) 🤦♂️. Problem was that I became very attached to it before we took it to the shelter a few days later. Paid for all the vaccinations etc. Some good karma kudos acquired.

4 - Valuable Content Consumed This Month 🥸

1 - on

Great to listen to the bloke/mentor I get most of my investing ideas from, on my favourite mining podcast.

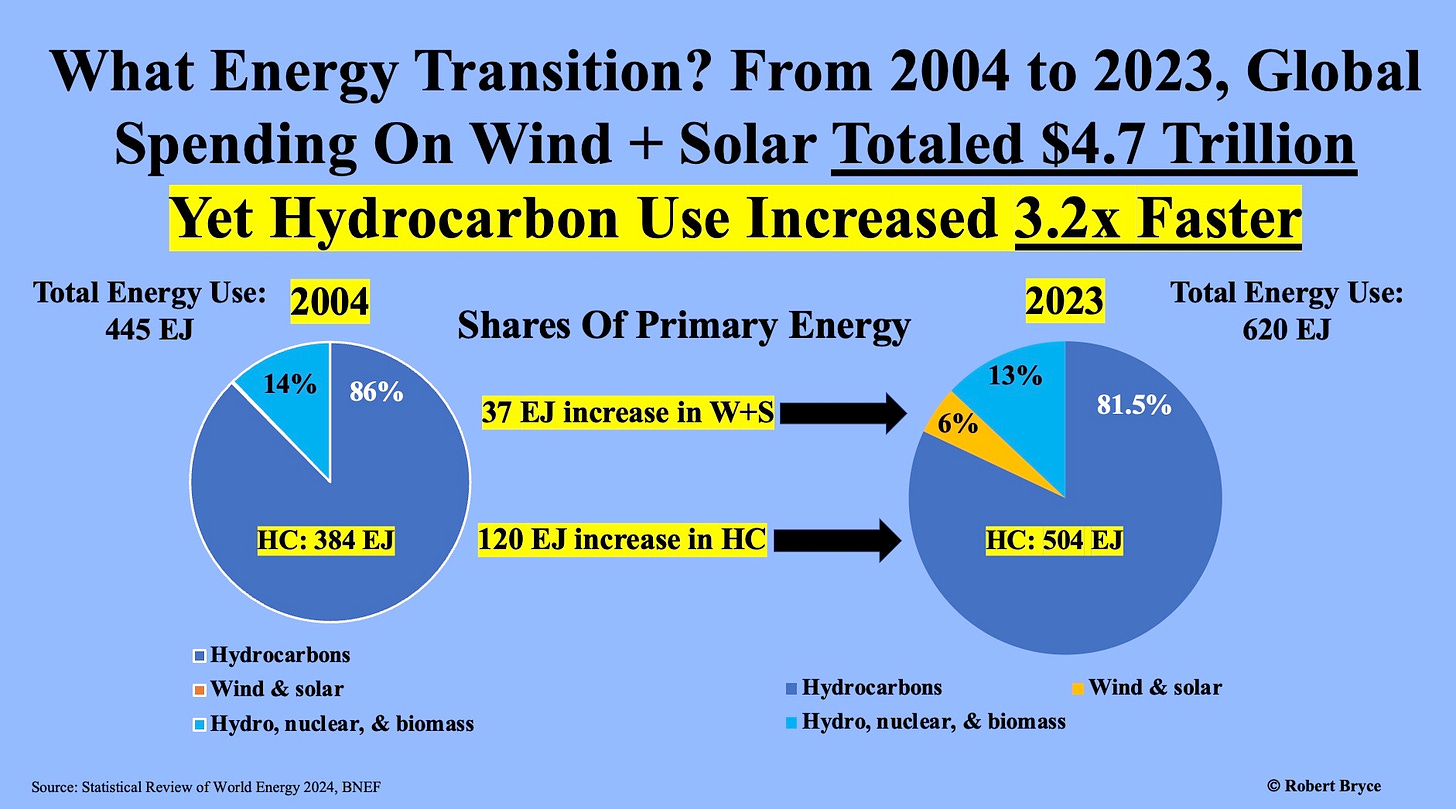

2 - I learnt that global hydrocarbon use and CO2 emissions hit new record highs in 2023

In 2023, total global power generation increased by 2.5% to 29,924 terawatt-hours, as developing nations continue to build out their fossil fuel generation capacity (as they should..).

The Statistical Review, shows, yet again, that despite the hype, subsidies, and mandates, wind and solar energy aren’t keeping pace with the growth in hydrocarbons. Global hydrocarbon use and CO2 emissions hit record highs in 2023, with hydrocarbon consumption up 1.5% to 504 exajoules (EJ). That increase was “driven by coal, up 1.6%, [and] oil up 2% to above 100 million barrels [per day] for the first time.” Global natural gas demand was flat, mainly due to stunning declines in Europe. Gas demand in the U.K. fell by 10%. It also fell by 11% in Spain, 10% in Italy, and 11% in France. - From .

3 - Finished reading Doug Casey’s fictional ‘High-Ground’ series

I’ve been smashing my Kindle this year, managed to read seven books so far in 2024. Can not recommend a Kindle enough to anyone who travels frequently (you can also download books for free if you know how.. 😁).

Any fans of Doug Casey, contrarian investing or has a libertarian streak in them would enjoy these books. The first one (Speculator) is definitely the best, I’d give it a 4/5; with a storyline about contrarian investing in a fictional African mining company, a corrupt geologist and an African civil war, it was right up my alley. The other two were still good, though go pretty extreme in Doug’s libertarian way of thinking for my taste.

I’ve just started reading Ian Flemings original Casino Royale, & Dr David Buss’s The Evolution of Desire - I’ve been bloody fascinated with the field of Evolutionary Psychology for years, and David Buss is the ‘founder’ of the field.

4 - (Another) Piece by on the scientific illiteracy amongst the general populace.

On the level of scientific and numeric illiteracy amongst the general populace, pertaining specifically to the global anthropogenic energy system (Net-Zero, etc etc). It is important not to go into our own echo chambers here, or take moral high ground, as it leads to more polarisation of ‘the other side’ (I consider myself a moron 🤓). An interesting read, nonetheless!

El Fin 🙋♂️

Bloody busy month. Should be laying relatively low in Mexico for the next 2 to 3 months 🙏

Appreciate it if you made it this far 😹 hit the ♡ button & subscribe/share.

Cheers ! 🍻

Tom - Van Diemen 🦘

Great write up Tom. Agree about your observations of ‘The West’ and its outlook. One thing Ive learnt since C19 is that the ‘tin foil hat’ brigade (aka conspiracy theorists) aren’t wrong - just early!

The ability to be a contrarian thinker is quickly becoming a super power in all aspects of life!

Hit me up if you end up in Oaxaca. Would love to catch up over drinks or tlayudas. Also fellow escapee from the land down under and currently living in Oaxaca. End of July is a good month to visit here because There's a really famous festival called guelaguetza. Plenty of street parties and ferias happening for guelaguetza. It's probably the second best time to visit Oaxaca apart from dia de muertos