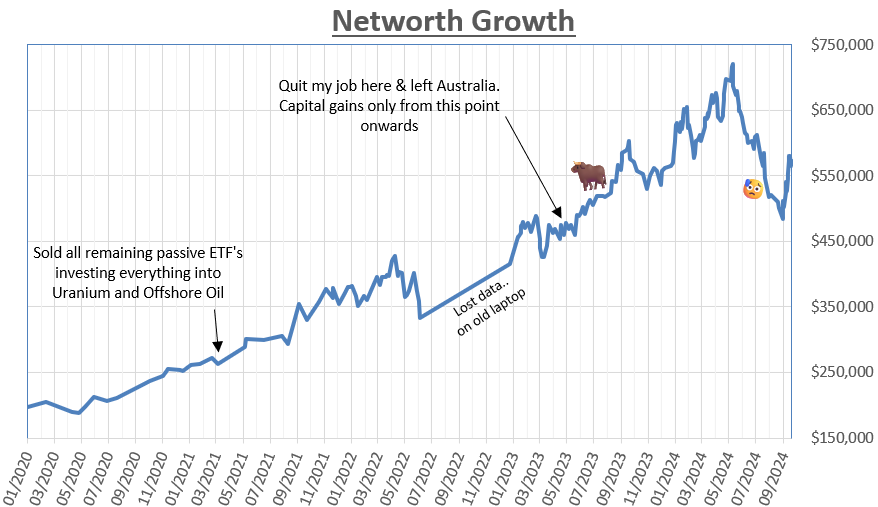

September'24 Portfolio/Life Update 💹 $575k (⬆️$65k) - Paraguay, Brazil, Argentina & Chile Next Month ✈️ & The First Green Numbers in 3 Months...🕺

The portfolio has come off life-support, finally 📈 A quick tour of The Southern Cone in October 🌎 Australia's slow decline 🪃 Tall Poppy Syndrome 🌱

Documenting the financial/life journey over my 30’s, attempting a different path to the societal norm while still chasing 'success' (& more freedom), & sharing where I currently am in El Mundo 🌎.

I enjoy writing - This is just a monthly journal that I’m making public..

Subscribe for some banter, hit the ♡ button, & share with friends.

Thanks for reading 🦘 Subscribe for free for new posts - I will not spam you.

1 - Pondering Australia’s Fall From Grace 🦘

2 - Portfolio/Market Update 🪙 ⬆️$65k

3 - Tall Poppy Syndrome 🤔

4 - September Life Update ✈️

5 - Plans for October 🌎 A tour of the Southern Cone 🧳

6 - Valuable Content Consumed This Month 🥸

People will criticise you (online) because it helps them to justify the risks that they chose NOT to take, in the hopes that their criticism (consciously or subconsciously) will dissuade you from sticking your head above the parapet and doing something different from the herd, so that in the end you will be in same relative position as them (crabs in a bucket), which in turn justifies that they made the right call (with doing what is typical in society). - Me

More on this 👆 in part 3 👇

Caveats -

I left Australia & a well-paid job as a Senior Mine Geologist in May 2023 to travel, live O/S & start a new chapter, after strong feelings of disillusionment with my home country from the covid years (I enjoyed my career but not the lack of freedom) - Not had a job/income since.

Write these updates as a form of cathartic journaling - Not selling anything.

I don’t use AI to create any content ✍️ Just random thoughts of what was on my mind for the month.

Don’t compare yourself to others. Some people reading this will be 10 years younger and already hitting 6 figures, others 10 years my senior and for whatever reason only starting their financial journey now. It’s all subjective - & it’s your journey, who cares.

Had $0 savings in 2016 at age 26.

Cashflow is much more important than networth - this is my goal for the next 2/3 years; to hit $10k AUD (minimum!) per month consistently, & grow this.

Never been in debt for anything. Never owned Crypto. No kids or dependents (yet).

Wrote about my issues with ‘FIRE’ & dividend investing here (how I used to invest).

All in AUD (‘Pacific Peso’ - plan to earn USD in 2025).

Do not think I am rich (actually, the opposite).

Financial goals for the next 2 -3 years:

1) Convert uranium (& potentially oil) stockmarket gains into online assets that yield cashflow in 2025 (entrepreneurship..).

2) Break tax ties with Australia & become a non resident.

1 - Pondering Australia’s Fall From Grace 🦘

Matt Barries phenomenal keynote speech - A must watch

I wanted to put this at the top, as it really struck a chord with me.

No matter where you sit on the political or ideological spectrum, this is an absolute banger of a speech - on the slow slide of our once great nation into Project Zimbabwe.

You could hear a pin drop for the entire 1hr 20mins (it is worth your time).

Every point Matt makes is backed up with charts and sources.

Here is the original written essay if you prefer to read.

I encourage you to share with family and friends, even if you only skim watch part of it. The Australia I grew up in in the 90’s and 00’s is an unrecognisable country to the one that exists today.

1 quick minute on my soap box 👇 Before I get to the portfolio stuff..

I am proud to have a kangaroo on my passport, and lucky to have grown up in the best country in the world (by far) at the time. I’ve travelled to over 50 countries and still think Australia (on the whole) is probably the most geographically beautiful in the world (once you get off the tourist path).

My Dad’s Dad died before my Dad was even born, fighting the Japanese at the Battle of Shaggy Ridge in Papua New Guinea, my own Dad fought in the Vietnam War, & my Mum’s Dad fought in the Battle of the Coral Sea (first time in World War Two the Japanese were defeated by Allied Powers).

My family has been Australian for many generations, so seeing the raw facts from the above speech above does really pain me.

Similar to a Canada or an Argentina, given its natural resource endowment and educated populations, Australia really should be one of the richest and powerful countries in the world. The largest exporter of iron ore, the highest quality coal in the world & third largest exporter of LNG - we should be a steel manufacturing powerhouse with the cheapest energy in the world.

I won’t bang on about it anymore, watch the keynote!

Unfortunately, I do not see things improving over the next decade, & it all makes me feel better about leaving in 2023 with plans to (hopefully) divorce from the taxation system in 2025.

I can still spend a few months each year visiting Aus, while living somewhere else. This is optimal for me.

Voting as an individual is pointless, but voting with your feet and changing your life means something. Though I totally understand that this is considered extreme for most people. Maybe I will move back one day (when I am not welcomed to my own country), who knows.

2 - Portfolio/Market Update 🪙-⬆️$65k

The slow recovery back to the highs of May begins (hopefully).

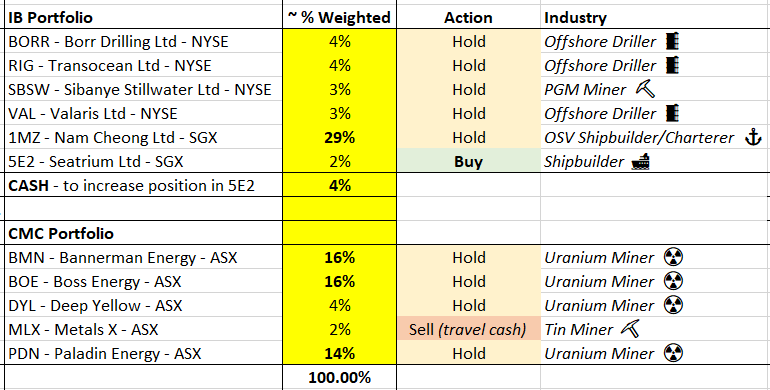

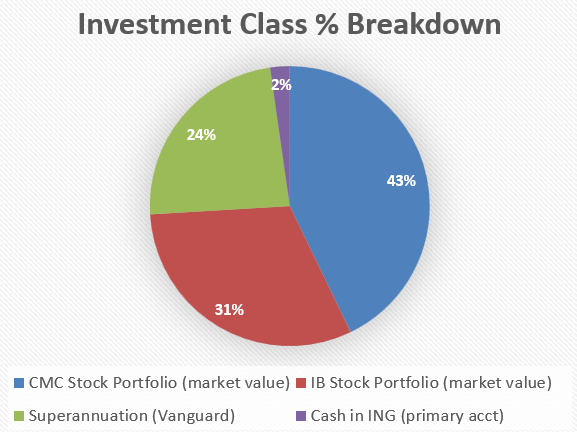

Portfolio Average Weightings ⚖️

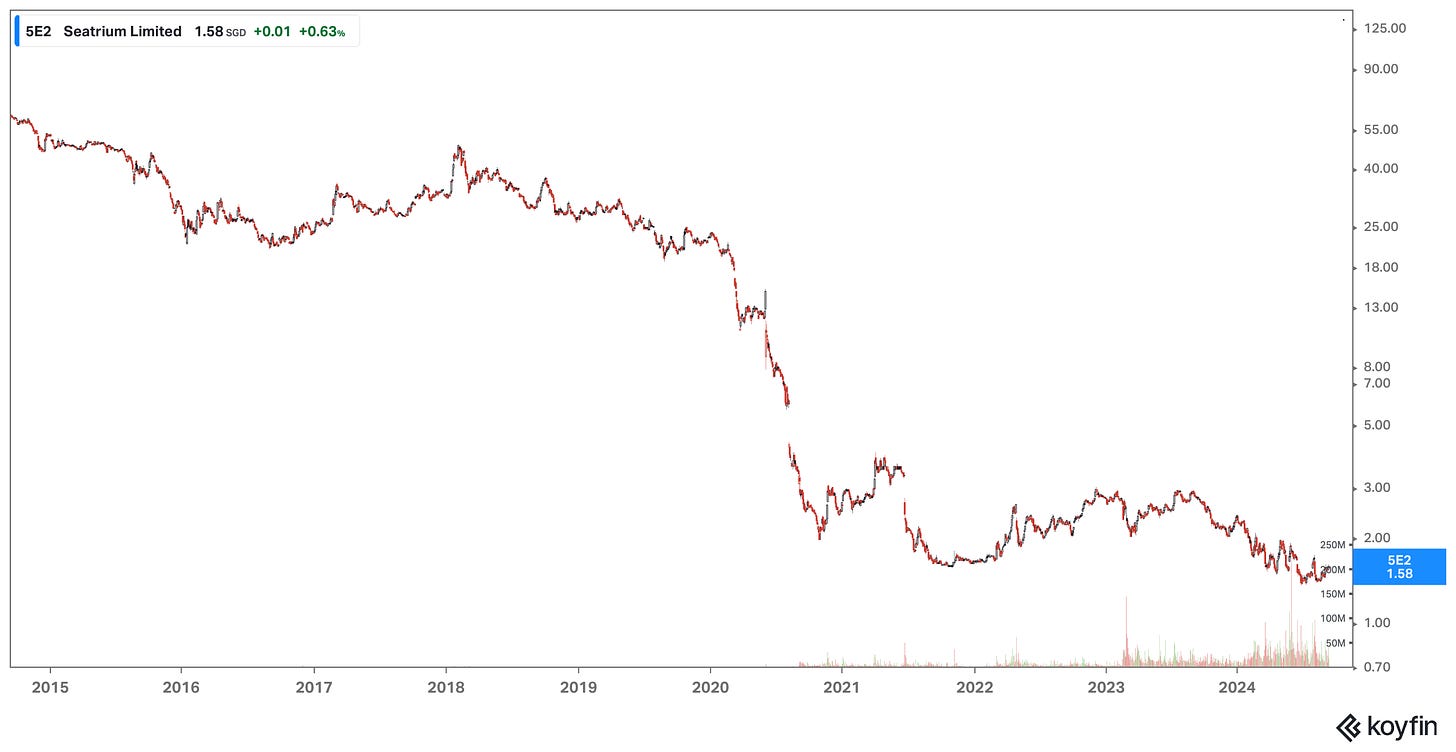

Seatrium - 5E2 🚢

I have held a small position in Seatrium for about two years, from when

talked about it a few years ago (when it was Sembcorp Marine). I saw this small position chop sideways for 2 years (about 20% underwater on it); but this month started to add capital to the position again (now in the green about 5%).

If you’re interested in this stock - I’d recommend reading Fergs recent write-up👆

Also wrote a piece on it 👇

I won’t re-write the detailed thesis of others here and pretend it is my own - as the majority of paid Substack accounts do (if you are new to Substack, be careful with this, there are a lot of charlatans out there).

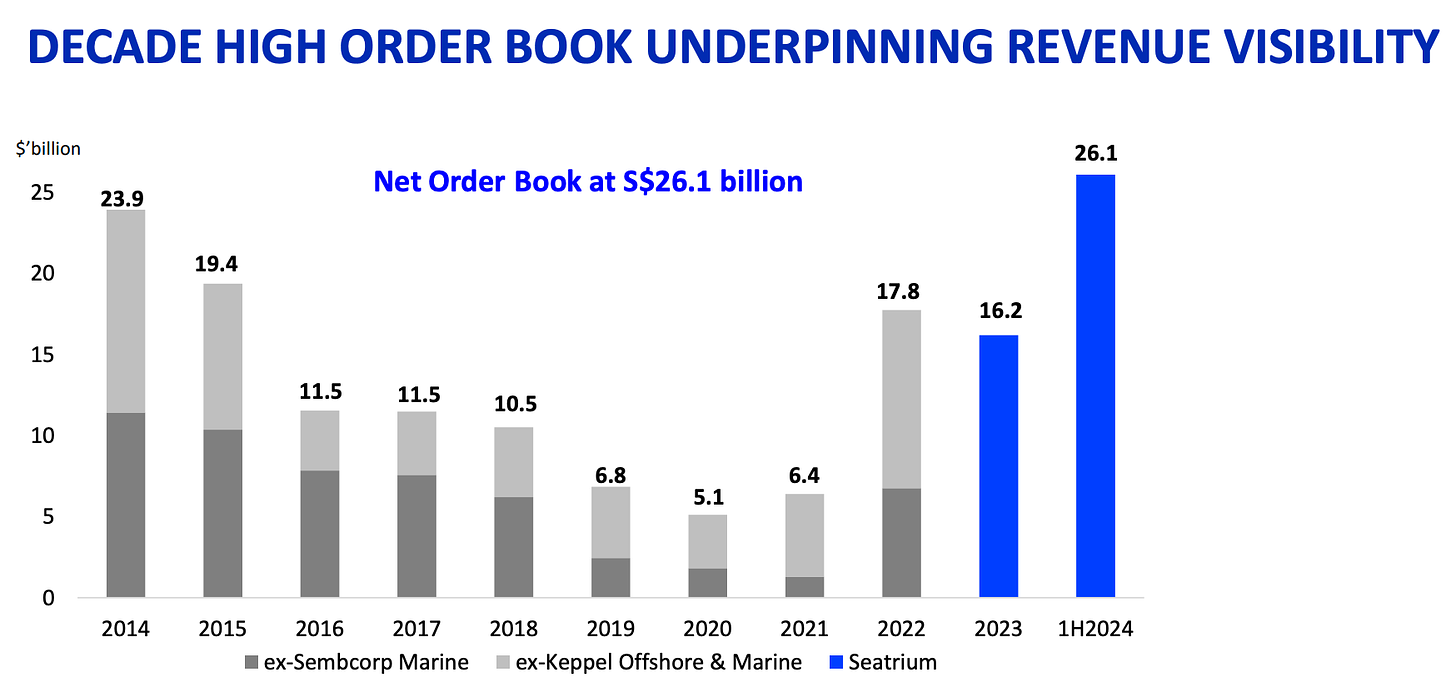

Seatrium - 5E2 thesis summary:

Some points from , & random subscriber John.

Highly shorted on SGX (contrarian).

Recently been buying back shares.

Asymmetry is there - overall fundamentals are bullish over next 5 years.

Strong order book, with big customers (i.e building the massive FLNG platforms for Petrobras, which take many years).

Many of its competitors have exited the space in the last few years (brutal bear-market in shipbuilding).

I also like the idea of getting a significant chunk of my networth out of the AUD (pacific Pesos) & into SGD (Singaporean Dollars), in terms of a fiat diversification play.

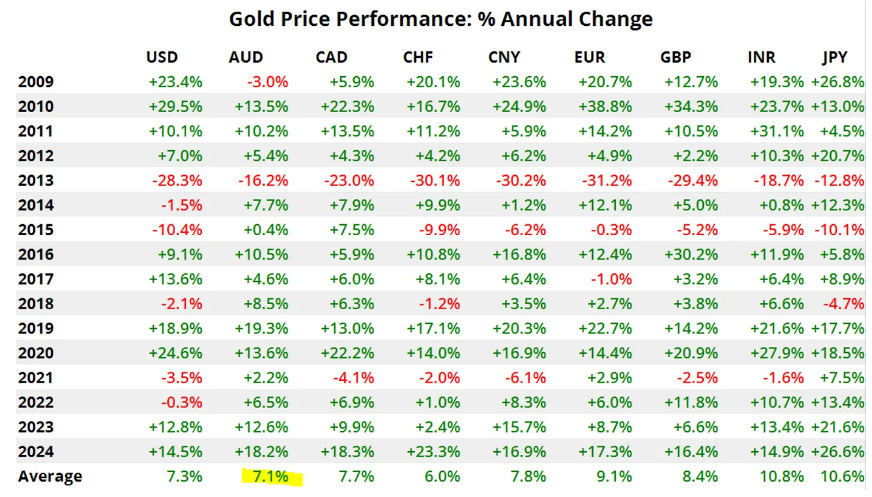

The chart below illustrates that the AUD has devalued 7.1% per annum over the last fifteen years, as measured against gold.

According to ChatGPT, the SGD has depreciated by roughly 4.7% per annum against gold over the last 15 years, still terrible, but less terrible. I understand that all fiat is devaluing rapidly and that gold/precious metal is real money - but still, nice to have a big chunk in SGD.

A whole other topic but IMO you need to be making >10% returns per annum on your money, just to keep up with real inflation (fiat vs gold, i.e real money). I may rant about this in another post in the future - but think about the amount of people that invest in passive, chasing a ~7% market average return (FIRE investing), and following ‘the 4% rule’ - are you really keeping up with fiat devaluation/inflation?

U Need to Focus on Term ☢️

Great commentary from Kuppy for any uranium investors on the term vs spot markets (link in title 👆).

..the spot market is a derivative of the term market, and the term market has gone rather illiquid lately. Unless someone steps up in the term market, the spot market can only do so much.

If you’re gonna be in this space, you have to make volatility your friend.

It's been amusing on X/Twitter the past few months, seeing yet another “uranium bro” announce to Fintwit that they're giving up on uranium. People can't handle the volatility, which essentially means, "The market isn't behaving how they want it to".

I bet these same guys are buying back in now as uranium equities have violently retraced many of their losses in just the last week.

We're in a long-term bull market for uranium - a commodity that powers >10% of the world’s electricity.

Patience is crucial. Remember Buffett's advice - “the stock market is a vehicle to transfer wealth from the impatient to the patient”.

The above also had me pondering 🤔 Stop Losses make you short volatility.

By putting in stop losses, you are essentially saying that if there is too much volatility, you're out. This is fine, but one could argue that this meant you didn't have conviction in the original thesis anyway..

We saw this with many people on FinTwit this month with SBSW - Sibanye Stillwater. If you added at or under $4, you have been rewarded/ or lowered your cost position close to 0%.

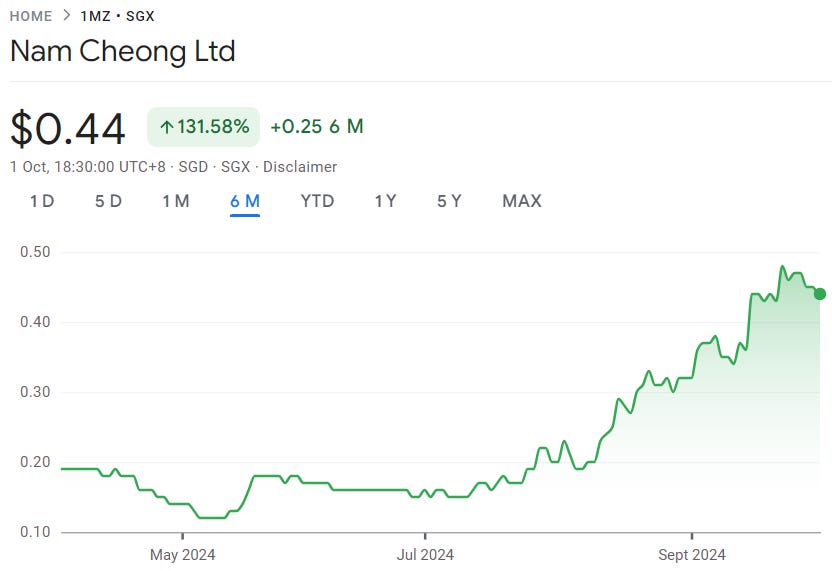

1MZ - Nam Cheong Update ⚓

Nam Cheong: Jumps 100+% in 2 months as 1H results point to low valuation

Another great article written this month by

on Nam Cheong. Well summed up, so have a read an I won’t repeat much of it here 👇.As you saw from the table above, I am irresponsibly overweight in this position, but I believe the risk-reward is there, and this is mostly likely a long-term hold of 5+ years as the cycle plays out.

Plus, I can take small slices of capital off 1MZ over the next few years and redeploy to other stock and business opportunities (better than having it in the bank!). I am already sitting on ~50% gain in the position, so the downside risk is small.

I have a strong bias investing in the OSV (offshore service vessel) space, after making a 494% return off MMA Offshore earlier in the year (my best investment to date), before the company was bought out.

Does this mean I have some emotion in the trade? Maybe. I should reflect on this more…

3 - Pondering Tall Poppy Syndrome 🤔

Another quick tangent from the usual format, bear with me 🙂

The feedback I have received since sharing some of my portfolio/life on Substack - mostly out of enjoyment from writing & for something to do - has been either extremely positive (95%) or extremely negative.

The only negative feedback has been from other Australians, interestingly.

Which had me thinking..

People will criticise you because it helps them to justify the risks that they chose NOT to take, in the hopes that their criticism (consciously or subconsciously) will dissuade you from sticking your head above the parapet and doing something different from the herd, so that in the end you will be in same relative position as them (crabs in a bucket), which in turn justifies that they made the right call (with doing what is typical in society).

This is extremely relevant in Australia's Tall Poppy Culture (and dare I say The UK/Ireland too), although maybe less so within the North American culture; this can be applied to any aspect of your life (not just my situation).

I am sure there are others out there that relate to this 🤷♂ In Australia you are absolutely looked at as the odd one out, if you are in your mid 30s without a mortgage and ‘still travelling’.

A slightly nuanced example - I know an American guy over here in Mexico who quit drinking alcohol cold turkey earlier this year 🦃 and had a very similar thing happen with his friendship group.

He talked to me about there being an initial stage of loneliness/discomfort, and second guessing his decision, which after some months led to a newer (better) friendship group, and him becoming subjectively more happy.

Interested if anyone reading has had similar experiences with this…

4 - September Life Update ✈️

Not much to report. As I mentioned last month, September has been a relatively boring month - which has been great.

One thing of note - we have had a heap of earthquakes in Mexico City this month. One night it set off the car alarm of my gf’s Audi in the garage, and shook the crap out of the bed (she was convinced it was a ghost..).

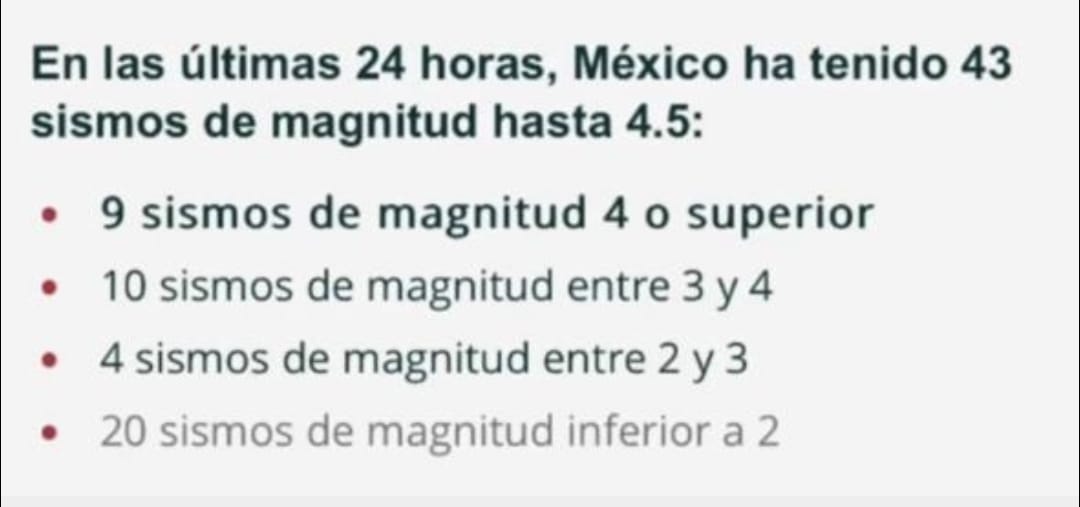

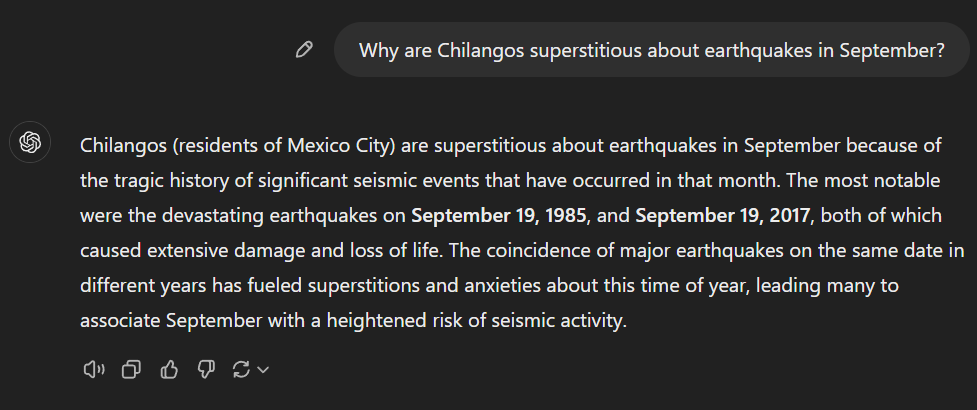

Chilangos (people from Mexico City) have a suspicious belief that September is a bad month for earthquakes 👇. As a former geologist, and growing up in Australia with essentially 0 seismic activity, I find it fascinating.

I also got to experience a ‘Mexican Baptism’ this month. Although I am a rather extreme introvert, one thing I do love about Latin American culture is the centrality of family celebrations.

This baptism was of a distant niece of my girlfriend, held at a huge colonial hacienda on the outskirts of Mexico City and attended by hundreds of distant family members, all dressed super formally.

Lastly, some epic Mexico City fine-dining, where the chef cooks your meal at your table.

While ‘expensive’ by Mexican standards (worth it, food was incredible), this same service back in Australia would have been 3x the cost…

4 - El Plan for October (& November) 🌎A tour of the Southern Cone 🧳

Paraguay > Brazil > Argentina > Chile > back to Mexico

1 - Asuncion, Paraguay (5th - 17th Oct)

Booked in to get Paraguayan Temporary Residency in Asuncion, & meeting up with mate

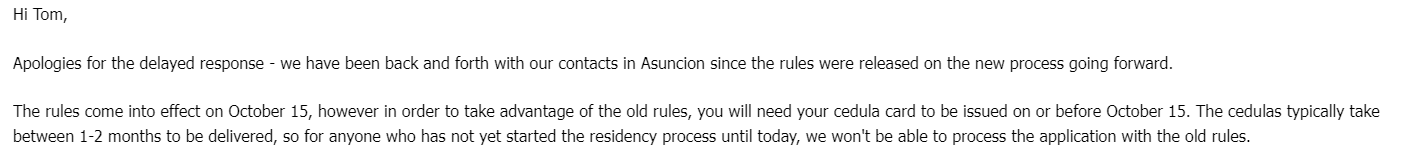

while he does the same. Looking forward to finally indulging on some of Paraguay’s cheap steaks & catching up with a good mate 🥩.Super bloody annoying update on the residency situation: The government has now changed the rules, and you can no longer get your residency AND your cedula card ID on the same trip - you now have to make two trips to Asuncion (they won’t mail it out to you, as they did previously).

I’ll have to make arrangements to come back in 2025 - potentially en-route back to Mexico from Australia in March…

I have mentioned this before; governments will continue to change the rules and make these residency programs more difficult to get, particularly, IMO, as Western countries continue their slow decline. There is a backlog now on processing residencies, due to the sheer volume of people coming to Paraguay to get a ‘Plan B’.

I am low-key stressed about getting Mexican and Panamanian residencies next year, in case they change the solvency rules within the next 6 to 10 months.

I want to make a prediction here right now - I predict (roughly) ten years from now, residency programs that are currently relatively easy for someone from a Western middle class to obtain like Mexico, Paraguay etc (in terms of solvency), will probably be only attainable for high net-worths & millionaires (excluding tiny countries like Pacific Nations).

If you’re on the fence about applying for a residency program somewhere, I would recommend taking action in 2024.

2 - Rio de Janeiro, Brazil (17th - 27th Oct)

Plans to meet up with another Aussie mate of mine who is currently travelling around South America. We used to live together in Sydney in 2023, so it will be good to talk some shit and catch up.

Rio is another bucket list destination for most people, so plans will be to get a pad on the beach near Copacabana for at least a solid week. 🏖️

At time of writing, this mate of mine is recovering from surgery on a broken foot, in Lima, Peru🦙. Won’t hold my breath on meeting him in Rio, hopefully he will be alright!

3 - Buenos Aires > El Calafate (Patagonia), Argentina (27th Oct - 10th Nov)

I have still not yet visited Argentina, so I am bloody looking forward to it, especially going into November, with the weather heating up down there.

Plan is to spend about a week in Buenos Aires, again rendezvousing with Jordan & testing out some of his favourite local Parrillas.

After this, I’ll be flying down to El Calafate for some hiking and to take in some of the sights of Parque Nacional Los Glaciares. Will try get up to see Mount Fitz Roy & El Chaltén too while I am there. To say I am excited to finally visit Patagonia is an understatement (both in Argentina & Chile).

4 - Torres Del Paine (Patagonia), Chile (10th - 19th Nov)

I picked El Calafate as a destination because of its proximity (including a road border) with Chiles famous Torres del Paine Parque Nacional - one of the most famous national parks in the world.

Plans are to cross the border by bus and go into Puerto Natales, the gateway town into Torres Del Paine. The vague plan will be to hire all the necessary hiking gear in Puerto Natales, and then complete The W Circuit Trek in the park - Would love to do the longer and more famous O Circuit Trek, but you need up to 10 days to complete this one, and I will not have the time.

After this, its two connecting flights through Los Andes up to Santiago.

5 - November 20th - Back to Mexico!

Back to Mexico for about one month (couldn’t get much more time away without getting into trouble..) & then it’s back to Australia for Christmas (returning to LatAm in 2025).

This will be 19 months out of Australia for me. It certainly does not feel this long, although looking back, it feels a long time ago when I was in Bali in May 2023..

5 - Valuable Content Consumed This Month 🥸

1 - The Power of Being Right Once: Lessons from Asymmetrical Trades -

Had to give my mate a plug. A great (free) article that sums up how we both view our finances and life decisions currently.

What he discussed ties in directly to what I talked about in:

2 - on Diary of a CEO Podcast - A fantastic discussion on ‘Wokeness’ & other similar issues.

is someone whose content I really enjoy, as he is able to remain ideologically agnostic in most respects. Although I don’t agree 100% with everything he says hook, line & sinker, his book, An Immigrants Love Letter To The West is one of the best I’ve read this year (super easy and quick read too). 3 - Why There Will Never Be A Zero Emissions Electricity System Powered Mainly By Wind And Sun

Stole this one off

- The current batch of Australian politicians in power would do well to read this great short article. Link in title 👆.“Net Zero” — That’s the two-word slogan that has been adopted as the official goal of every virtuous state or country for decarbonizing its energy system. The “net” part is backhanded recognition that some parts of the energy system (like maybe air travel or steelmaking) may never be fully de-carbonized.

4 - Australia’s Misinformation Police -

Great Piece on the Australian Governments new controversial ‘Misinformation Bill’, written by an outside Americans perspective

(the author) is a fantastic follow on Substack if you are interested in the whole climate change/catastrophe narrative (a whole other topic). He wades off into discussing testifying in congress, but ties it back to the new bill in Australia at the end.The legislation is silent on how “false information” is defined and by whom. The self-appointed Australian Associated Press (AAP) FactCheck — is cited as an arbiter of truth claims, and thus with the implied governmental authority to identify true and false claims under the proposed legislation.

That’s all for September

Hit the ♡ button if you got this far - Cheers ! 🍻

Tom - VanDiemen 🦘

Love these! Thanks for the shoutouts mate! Just glad I have another big aircraft to talk to about these things with. 😜

It sounds like an epic trip. I visited places like Buenos Aires, Rio de Janeiro, and Ushuaia. Have a great time!

I can confirm the high costs in Australia. From 2015 to 2018, I had the opportunity to visit Sydney and Melbourne. Even then, the prices were way higher than here in Eastern Europe. I remember I paid AUD 50 for pizza with salmon, while for the price in Sofia, I could get a good steak.

Matt Barries' write-up on Australia is genuinely phenomenal. Unfortunately, this is the current path for the Western World. Going full Zimbabwe and total commie seems the new "normal."