May '24 Networth/Life Update📉$679k (+13k) - Hiking La Cordillera Blancas/Huaywash en Northern Peru🦙(how we failed..😵) & Recouping in Beautiful Arequipa ⛪

55k bounce in the portfolio this month before a big pullback in ☢️, trekking in the Peruvian Andes while getting sick as a dog 🤢 & chilling out in Arequipa

Sharing these updates to show the financial journey over my 30’s, stay accountable, prove that you don't need to follow societal norms to be financially 'successful', & show where I am at currently in El Mundo 🌎 ✈️

Wrote an intro on who the hell I am here if interested.

Caveats -

Only started tracking my networth in 2020 (unfortunately).

Had $0 in 2016 at age 26.

Never been in debt. No kids or dependents (yet).

All in AUD (the ‘Pacific Peso’ - plan to earn USD in 2025).

I do not think I am rich (actually the opposite!).

Not a digital nomad. Not had an income since June 2023.

Saved hard, built a stock portfolio and left Australia post covid to start a new chapter (still working this out!).

Financial goals for the next 2 -3 years:

1) Convert uranium stockmarket gains into online assets that yield cashflow.

2) Start breaking tax ties with Australia.

Don’t compare yourself to me. Some people reading this will be 10 years younger with 5x the networth, others 10 years my senior and for whatever reason only starting their financial journey now. It is all subjective - it’s your journey, who cares.

1 - Networth Update 🪙

2 - Life Update ✈️

3 - Plans for June 🧳

4 - Valuable Content Consumed This Month 🥸

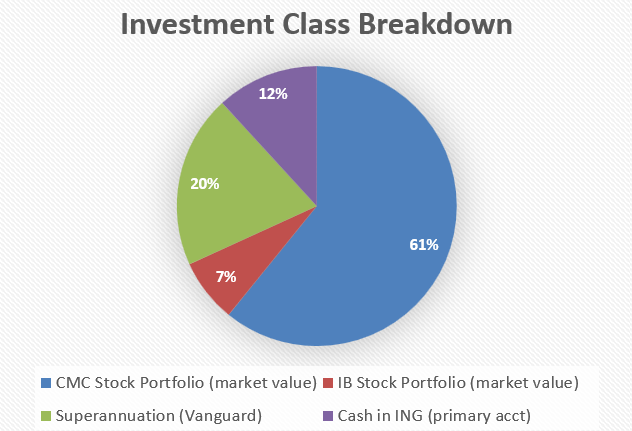

Networth Update 💰 $679k (+13K)

Why You Should Track Your Net Worth 👈 An interesting article on the subject from another blogger - though I think cashflow is more important & will become my main focus over the next few years.

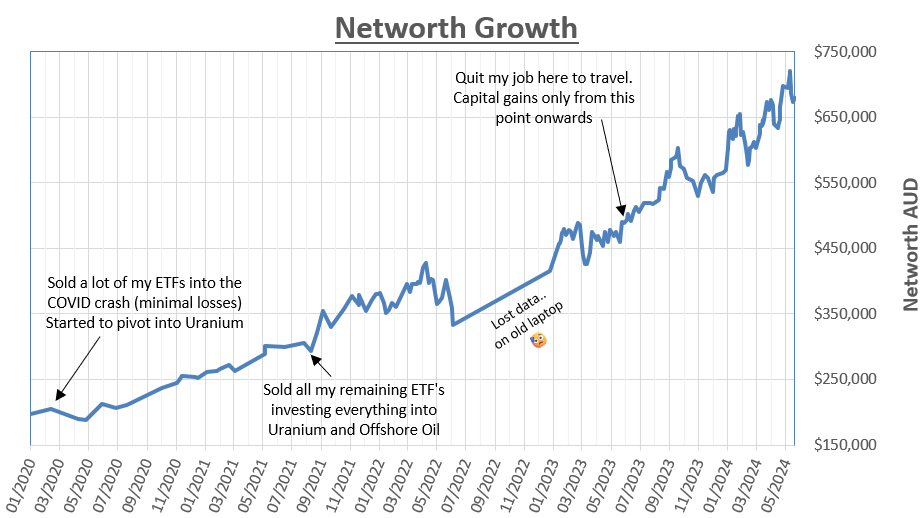

Up 13 grand for the month after uranium went on a mid-month tear (spike in chart) before a big pullpack last week, so basically almost back to square 1.

Another part of accepting the volatility of the thesis as the bull market gains steam; is being comfortable that as more capital enters the market (particularly in uranium as it is such a tiny sector) the severity of the pullbacks will increase exponentially. Looking at the bull-run in Bitcoin in 2020-2021 exemplifies this.

Boss Energy - Tanked the portfolio this month

Boss Energy has blown out to over 1/5th of my portfolio in the last few years (along with Bannerman & Paladin), so when the stock moves, I feel it. This month it went south by 11% in one trading day, when the CEO and some of the other directors sold huge chunks of their own equity.

Uranium miner tanks after managing director sells 70pc of his shares for $21m

In 101 investing this is obviously NEVER a good thing, but honestly it bears no relationship to the macro uranium thesis as a whole. The Money of Mine Podcast did a great yarn about it 👇 & explain the ramifications of it all far better than I could.

I was tempted to push some extra cash into Boss when it tanked, but I’m already way too overexposed to uranium (70%+ of portfolio..).

Before this pullback, uranium stocks were moving considerably this month - why?

Big tech (typically quite anti-commodities) is finally starting to realise that the exponential growth of AI data centres will require 365-day reliable non-renewable baseload power - nuclear.

US Congress is starting to allocate money to rebuilding the domestic fuel supply chain.

US signing into legislation the Russian uranium import ban (very bullish). The Pale Blue Bot Substack did a great summary on the implications of the ban here.

Kazakhstan (the largest producer of yellowcake in the world), continuing to run into production problems, AND selling less and less uranium to the West.

China currently has 27 reactors under construction and plans to almost triple their current capacity (54GW) over the next ten years.

I sold $5.5k ish of SHIP (for a small 10% profit) - cash for travelling 💵

Held a small position in this guy for almost 2 years (dry bulk shipping thesis). It basically went sideways, but I made enough of a gain to (barely) keep up with inflation 😆 This small cash injection puts my ‘travel cash’ back up above 10k.

Unable to increase daily transfer limits to above 5 grand a day in Aussie bank account…

As I mentioned last month, I had about 93k cash from the forced sale of MMA Offshore sitting in the bank (494% gain 💥). Plans are to use about $50k-ish of this for short-term options trading for income (something I have been meaning to get into for over a year..). The rest will be used to top-up my positions in RIG, BORR & WHC.

I managed to rectify access to my Interactive Brokers account after smashing my phone (completely fked it) in Lima last month (international calls are a nightmare in Peru).

However, now I’m unable to change the daily transfer limit in my Aussie bank to more than 5k without calling them.. Do you think I can get through to their call centres to change it (been on hold twice for >45mins..)? 🤬 So its probably gonna take a few weeks to get all ~75k into IB 😂

Networth less superannuation = $543,152 (USD $361,837)

Mentioned previously that I am not fan of superannuation as it is not really my money and therefore should be discluded from networth.

Life Update ✈️

Never thought I’d be the guy to share motivational quotes, but recently read an insightful piece here on Substack that was full of thought provoking ones.

Your future-self would do anything to be you again. Treasure the time you have like you treasure the good old days, because today and tomorrow are the future’s good old days. - Gurwinder

On reflection, I did a lot in May! Strap in, quite a bit to go over here 🌎

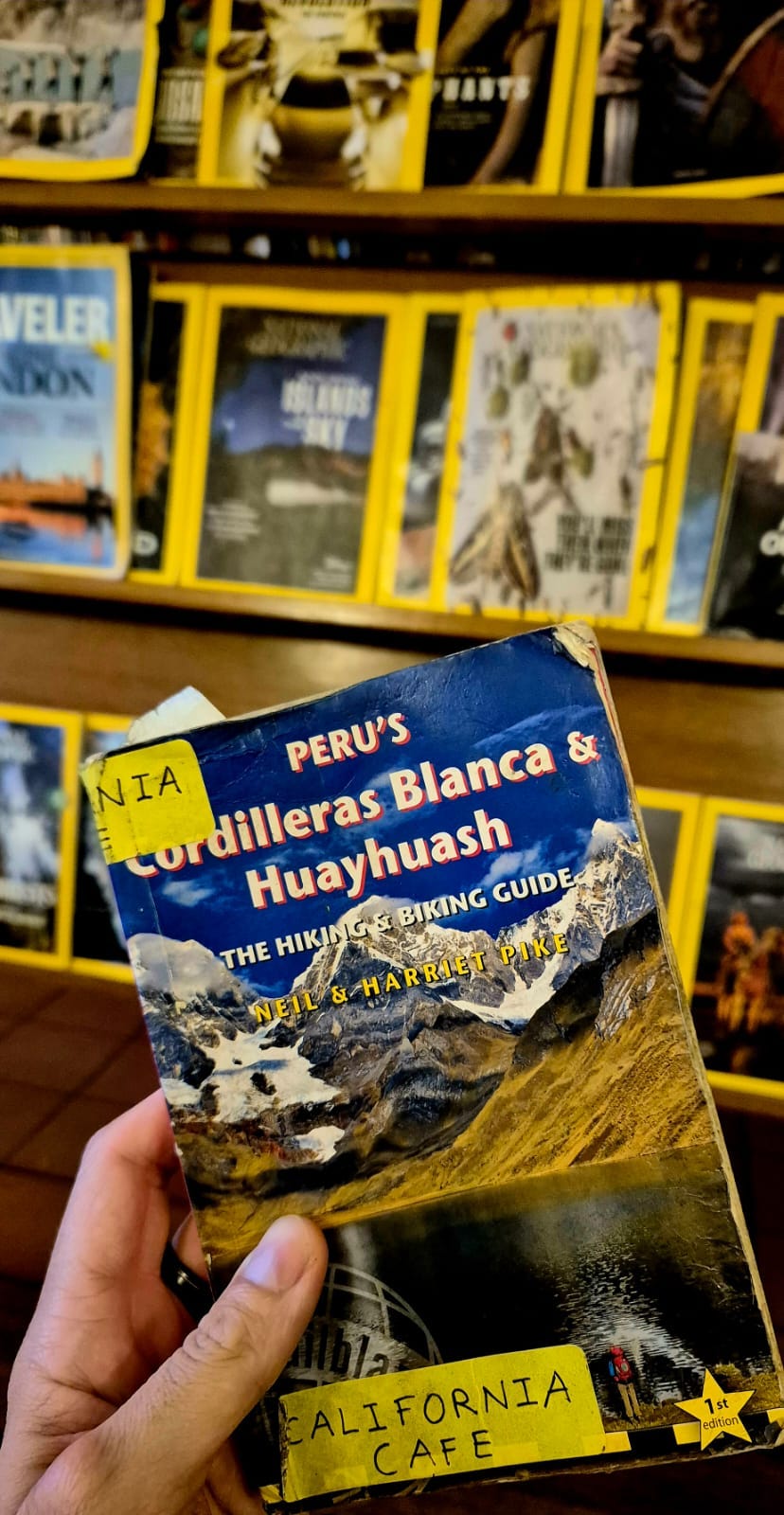

After spending a month in Miraflores, Lima and rendezvousing with a good mate - We jumped on the 9 hour bus to the mountain ciudad of Huaraz (who some call the Switzerland of Peru, although it’s a very ugly city..). This area is famous globally for its hiking and mountaineering due to the proximity of the Cordillera Blanca & Cordillera Huayhash (pronounced ‘Why-Wash’).

It all started out well, spent a week in Huaraz (3,050m) with the plan to acclimatise before we embarked on the infamous Huayhash circuit trek, a 9 to 11 day hike in which only ONE DAY goes under 4,000 metres altitude (you start at about 4,250 metres).

Unfortunately both Jordan & myself picked up a serious fluey virus in Lima, which started to hit us on the bus trip on the way up to Huaraz from Lima 🤧Impeccable timing.

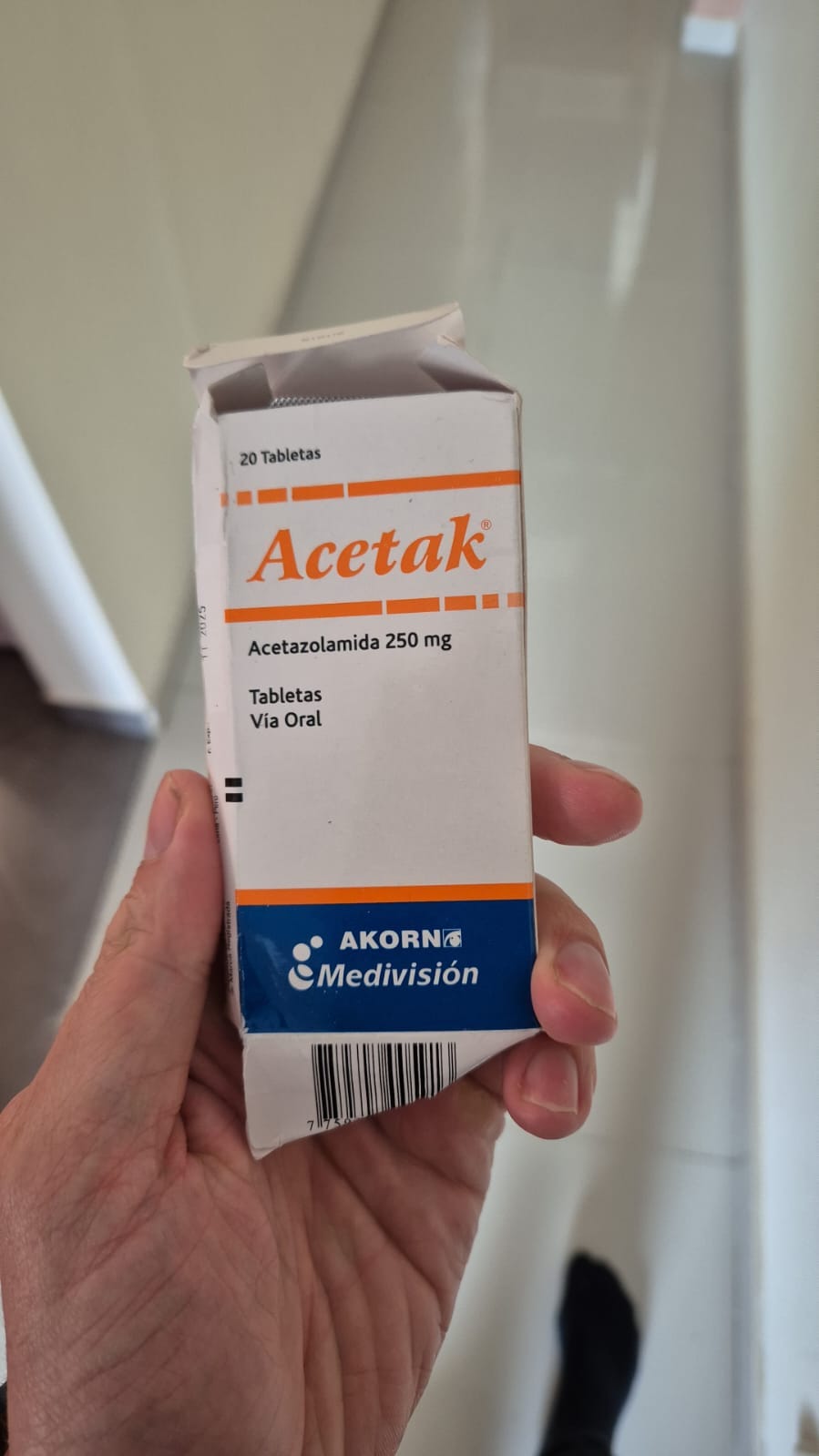

We assumed that one week would be sufficient to both get over the flu & to acclimatise sufficiently. We started taking Diamox once we arrived in Huaraz (helps with the altitude).

The rest of the week was spent resting up, spending a lot of time in the two amazing ‘hiking’ cafes (for lack of a better term) in the town; California Cafe & Cafe Andino.

We did 2 dayhikes in the week preceding Huayhash, one to 3,700m and one to 4,600m. Though still crook 🤧 we felt pretty good with the altitude!

Laguna 69 - Probably the most popular dayhike in the Cordillera Blanca. We ended up getting the later bus in the morning (most people get the 5am one, but we went at 9am because we were still sick), which was perfect as by the time we arrived at the Laguna at mid-afternoon, we had the whole place to ourselves (minus a coyote 🐺).

Our annoying flu persisted all week; to the point where we extended our stay by another 2 days to try get over it.

Neither of us slept before the 3.30am wake-up for a 6 hour bus ride to the start of the Huayhash trail head.

Overpacking…

I’m 192cm and Jordo is about 201cm; it’s fair to say we both eat a lot of food, and even in our mid 30s we still typically order 2 main courses when we eat out, even if not training. For the 9 days of food we needed, we packed WAY too much, with both of our packs weighing close to 30kg when we set off (idiots).

Combined with the fact that the trailhead started at over 4,200m altitude, we had not slept the night prior, we were both still sick, the backpacks we hired were old and shitty (broken zips etc), and that we had basically done next to no training, we had set ourselves up for failure from the outset.

Most people opt to do the HuayHash as part of a paid expedition, where donkeys carry all your stuff, and meals are provided at night etc, while you only carry a daypack. We were too stubborn to even contemplate an expedition… 😆

We certainly started to rethink this on the big climb on day one, as packs of donkeys and hikers with 5kg daypacks continuously overtook us…

I forgot to continue to take the Diamox altitude tablets that day - which meant my body started to come off the effects of the drug at altitude, resulting a super intense 8/10 headache that night (zero sleep again), while Jordo had developed an intense cough (later found out was bronchitis).

After much deliberation we decided to walk out the next day. We were 50/50 on this decision but thank god we made it, as we both deteriorated further in the coming days. All the following campsites of the trek bar one were higher altitude than this first one too, which would have not helped the situation (we didn’t have altitude sickness, but the altitude compounded the effects of the virus ☹️).

Walking out was a mission/adventure in and of itself. We walked about 15km to the nearest town, Queropalca which had one hotel that I don’t think had been used in weeks. This part of the Andes is seriously remote (not part of the Huayhash circuit) and there was absolutely zero English spoken.

In a cool twist of fortune, the locals took us to a local thermal sulphur hotspring (common in this part of the Andes), as there were no showers in the town (you read that correctly, the locals bathe only in the sulphur baths).

This next day saw us get 2 separate taxis, and another bus just to get back to Huaraz (12+ hours). We felt like death warmed up 🤒 and were somewhat humiliated after looking forward to the trek for months & was the main reason for coming to Peru😔 but we definitely made the right decision.

Huanchacao

I had planned to visit this little town on the northern coast of Peru to try get back into some surfing 🏄♂️ and see something different. If nothing else our bodies needed to get back to sea level for a few days to recuperate.

Although the waves are great, Huanchacao and nearby Trujillo (Peru’s third biggest city) are very poor areas and not a pretty place to stay. Don’t let the typical ‘everything about this place is magical’ travel blog fool you - there is rubbish and half-built mud-brick buildings with rio-bar sticking out of them everywhere, and some of the areas look like a bloody war zone - honestly some areas were analogous to images of Gaza on TV. Would still recommend it for a surf trip though. Easy and cheap to fly from Lima to Trujillo.

Neither of us ended up getting in the water once 😆 as we were both still crook/lazy.

We did however check out some amazing archeological sites nearby, including the ancient city of Chan Chan, which was the capital city of the Chimor, a civilization that pre-dated the Inca empire, and became their biggest rivel (the Inca eventually conquered the Chimor around 1470).

We also visited the El Brujo archeological site; a site that dates back to at least 200 BC (the Moche period), a long time before the Inca Empire even coalesced.

Arequipa

Flying from Trujillo to Arequipa was super cheap (<$100 AUD), as with most things in this amazing country. I’d planned to visit Arequipa in southern Peru on this trip, but given it little thought as you don’t typically hear much about it from the touristy or LatAm Twitter side of things. Wow, this city is an absolute hidden gem.

The Spanish Colonial Centre of this city is an amazing spot to park-up for a few weeks to chill and work (for the long-term traveller), or even visit for a week (would recommend one week minimum).

Arequipa is awesome - Why?

Beautiful old town with white volcanic tuff bricks (stark contrast to typical Peru, which tends to be quite ugly, sorry Peruvians!)

Cheap overall for everything.

Food - In terms of the price/quality, this is probably this best place I have been to for restaurants in the world. Cafes are amazing (Australian quality coffee 😏) with rapid WiFi, restaurants are incredible and both are always situated in 200+ year old colonial buildings.

‘Tres Carnes’ @ Zig Zag Restaurant - 70 Soles = USD $18 🤤 Hiking etc - There is heaps of outdoor stuff to do here (which is why you can easily stay for weeks). There are three prominent volcanoes that dominate the eastern horizon; Chachani (6025m), Misti (5822m) & Pichu Pichu (5664m), all of these can be hiked through countless companies offering trekking expeditions. There is also rock climbing, rafting and hiking in the nearby Colca Canyon (deeper than the Grand Canyon).

Arequipa was a stark contrast to Trujillo & Huaraz, with the beautiful Spanish colonial old town still intact and well kept, a much more ‘middle-class’ feel & amazing food.

I later discovered that the Cerro Verde Porphyry Cu-Mo Mine is located 1 hour from the city, this is the 5th largest copper mine in the world (in production capacity at 500k tonnes per annum), with reserves of >4.6 billion tonnes 🤯. This has had big implications of the wealth of the city, relative to other areas of Peru (such as Huaraz for example).

Drilling, mining, and refining are the lifeblood of bettering human lives - Full stop. Doing so domestically is synonymous with increasing wealth & geopolitical security for all countries. Another rant for another time.

3 - Plans for June 🧳

Next week - Heading to Cusco, Peru for a week to check it out. Plan to hopefully come back to Peru again in September/October and tackle the touristy things like Machu Picchu and Rainbow Mountain (my schedule is a bit out of whack at the moment).

June/July - Back to Mexico 🌯! Bit of a shakeup in my personal life (a good one). Really looking forward to heading back to Mexico for summer.

September - Plan to head back to Sudamerica; Paraguay to get the Temporary Residency. Was going to do this earlier but had some issues getting documents in Aus.

4 - Valuable Content Consumed This Month 🤓

List of some content I’ve read/watched this month that I found valuable, and aligns with my investing thesis and/or world views.

1 - Uranium Report Update ☢️

I try avoid most of the uranium hype now, especially as it slowly starts to gain traction in the MSM. But this report is part of Lobo Tiggres Independent Speculator, so is actually 💯 worth a read if you’re a 308 Bull like me 🐂☢️ It’s free to download and is very comprehensive.

2 - Ferg chat with Andy from Finding Value Finance 📝

Bullish hybrids, bearish EVs ⚡ (PGM trade)

Jumping on the gold-bug train 🪙

Bullish tin again (thankfully I still have a little MetalsX in the portfolio..)

US Shales becoming increasingly ‘gassy’ as their production profiles age (less oil, more gas = bearish for nat-gas, bullish crude longer term).

3 - Adam from G&R interview 🤓

I always try to watch/read everything that G&R put out, and if you’re not subscribed to their free newsletter then you are doing yourself a disservice as an investor. Skip to 1:32 on the below video for an insightful interview with Adam on all things commodities, and why he sees Bitcoin/crypto trapped at the whims of energy (aka electricity) availability.

4 - Australian Nuclear ‘debate’: Why the CSIRO are heavily biased towards an unscientific green/left narrative ☢️

As an Aussie, I have been keeping an arms length eye on the nuclear discussion (finally) starting to gain steam back in my home country. This one makes my blood boil, and I try not to get too involved. The CSIRO recently released a report stating that nuclear is significantly more expensive than using solar. The holes you can poke in this argument are so large that a primary school science student could do it.

The most glaring errors in the report are the assumptions about the upfront costs of nuclear plants, their rates of utilisation and their lifespans. The assumption on the capacity of wind power is also laughable, and the assumed life-spans of both wind and solar are too long.

It looks suspiciously like a tail wagging the dog exercise: how to ensure that nuclear power looks extraordinarily expensive compared to the preferred renewable energy option of the federal and state governments. - The Australian (below article).

Have a watch if interested, its only 10 minutes. See below this an interesting article from The Australian that also lambasts the CSIRO’s report.

5 - Adam from G&R on Macrovoices Podcast 💰

A podcast all commodity investors should subscribe to. Adam again doing the rounds - always a contrarian take on all commodity markets.

6 - Geologo Trader article on Copper 🪙

Geologo Trader did a great piece on Copper in Argentina that is well worth a read for any commodity investors out there. The stars could potentially align with the free-market Milei government coming to power at the same time that the copper price is finally starting to inflect. Remember Argentina straddles the same Andes mountains that allow Chile to be the ‘Saudi Arabia of copper’, while Argentina produces essentially zero.

7 - Ivor Cummins pointing out the hypocrisy of the UN’s Global Boiling narrative

🙀 Apologies, this one turned into a small rant!

Ivor Cummins is a must-follow for anyone out there who can think for themselves and wants an alternate view on all things. I stumbled across his stuff when I started to realise that what we are told about diet, nutrition and ‘meat is bad for you’ was all 💯 bullshit back in 2019 (write about this in the future).

He is an engineer with a career in consulting on complex problem solving - read his story here, and you should absolutely sign up to his free newsletter.

Ivor was instrumental for me during COVID as he clearly pointed out, using statistics & data, that the whole thing was nothing more than a bad flu (in 2020!) - and that lockdowns caused much more harm than good etc (a whole other topic).

Using facts, data and historical precedence he starts to poke huge holes in the whole climate catastrophe narrative; the whole idea that CO2 is correlated to changes in the Earth’s climate is a house of cards once you start digging (guess that makes me a denier 😮).

Climate appears much more correlated to solar wind activity, cosmic rays (from supernova), and the relationship that this has on water vapor (clouds) in Earth’s atmosphere (water vapor is 1000% more correlated to temperature change than CO2). Whole other topic but a bloody interesting one.

8 - Grant Williams on Commodity Culture Podcast

Discovered Grant Williams through

years ago. Always a great listen on anything investing related.El Fin 🙋♂️

Hit the like heart if you made it this far - Gracias!

Hey mate great read, love the content! Saw that you weren't a fan of super similar to me. Recently discovered an the Member Direct option on Australian Super where you can invest in ASX 300. Currently hold a couple of uranium, coal and gas names through it, might be worth a look.