August'24 Portfolio/Life Update 💹 $510k (-$75k) - Market Shits The Bed (again) 💩 Costa del Pacifico 🌴 Routine Mexico City Life 🌯 Paraguay & Panamanian Residencies 📃 & Going Long on Nam Cheong ⚓📈

1 Week on the tropical Pacific Coast of Mexico; Back to CDMX & into routine again: Paraguayan trip booked; Pondering formation of a Panamanian Corp & a big portfolio reshuffle into more asymmetry 📊

Sharing to document the financial/life journey over my 30’s, stay accountable, show that you can follow a different path to societal norms & still be 'successful', & show where I am at currently in El Mundo 🌎 ✈️ Essentially just monthly journaling but making it public!

Give a Like and Share if you get any value from this ☺️

16 minute read - Slightly longer one this month with a few rants. A bit late due to shuffling the portfolio @ start of September, in the midst of the market liquidity crisis…

1 - Portfolio/Market Update 🪙

2 - Life Update ✈️

3 - Paraguay Paid, Contemplating a Panamanian Corporation 🤔

4 - Plans for September🧳

5 - Valuable Content Consumed This Month 🥸

I left Australia & a well-paid job as a Senior Mine Geologist in May 2023 to travel, live O/S & try to start a new chapter after strong feelings of disillusionment with Australia from the covid years (I enjoyed my career but not the lack of freedom); To live life on my own terms & not at the whim of corporate PC Australia - Not had an income since.

Caveats -

Write these updates as a form of cathartic journalling - I am not selling anything.

I don’t use AI to create any content ✍️ Just a stream of consciousness of what was on my mind for the month.

Don’t compare yourself to others. Some people reading this will be 10 years younger and already hitting 6 figures, others 10 years my senior and for whatever reason only starting their financial journey now. It’s all subjective - & it’s your journey, who cares.

Only started tracking networth in 2020 (unfortunately) - Had $0 in 2016 at age 26.

I believe that cashflow is much more important than networth - this is my goal for the next 2/3 years; to hit $10k AUD (minimum!) per month consistently, & grow this.

Never been in debt for anything. No kids or dependents (yet).

Wrote about my issues with ‘FIRE’ & dividend investing here (how I used to invest).

All in AUD (‘Pacific Peso’ - plan to earn USD in 2025).

I do not think I am rich (actually, the opposite).

Financial goals for the next 2 -3 years:

1) Convert uranium (& potentially oil) stockmarket gains into online assets that yield cashflow in 2025 (entrepreneurship..).

2) Start breaking tax ties with Australia.

1 - Portfolio/Market Update 🪙

Another painful month. I am certainly training myself to not check the portfolio as frequently as usual.. (too depressing 😆).

Portfolio % Weighting and Company Tickers (new)

Big Portfolio Shuffle This Month 📊 Consolidation & Position Sizing

I used to run almost 30 companies about 2 years ago (many 1% positions) - trying to ‘diversify’ and be more risk averse. I have come to realise (again too slowly) the importance on position sizing, even though I have heard people I respect such as

talk about it ad nauseum. Also after a good yarn with on the topic earlier this month, it has made me realise it’s time to take position sizing more seriously on stocks that I have conviction in (money where my mouth is).Dumped my (relatively small) positions in Coal (BTU & WHC)

Still very bullish on coal over the next few decades; but with limited capital, the uranium side (biggest chunk) of the portfolio in the toilet & seeing asymmetric opportunity in the OSV space, I decided to sell out of coal.

I do hope to re-enter significant positions into coal companies in the coming years, once I have made some money from uranium/offshore + set-up a business for cashflow. The coal trade is a longer term dividend and buyback reinvestment strategy.

Consolidation of Uranium Positions 🤏

At the time of writing I am still in the process of selling out of four uranium names I have held for over 4 years. These are Peninsula Energy, Elevate Uranium, Lotus Resources & Global Uranium & Enrichment Ltd.

This was a hard decision.

I have been 110% on board with the uranium thesis since late 2020, but as I mentioned above, I need to take position sizing/conviction more seriously. Bannerman, Boss & Paladin will remain as my core uranium positions, with a bit left in Deep Yellow for more torque (these all remain well into the green despite recent pullback).

Peninsula, Elevate, Lotus and GUE are all in the red (not by a lot), even after 3 to 4 years of holding through the bull market. Using Peninsula as an example below 👇

This comes back to the point of asymmetric investing and why it is optimal to have a basket of companies, if possible. Some will need to pruned 🪓 while others should be let to run 🐂 (not ‘rebalanced’ back into the shitty companies, as modern portfolio theory advocates).

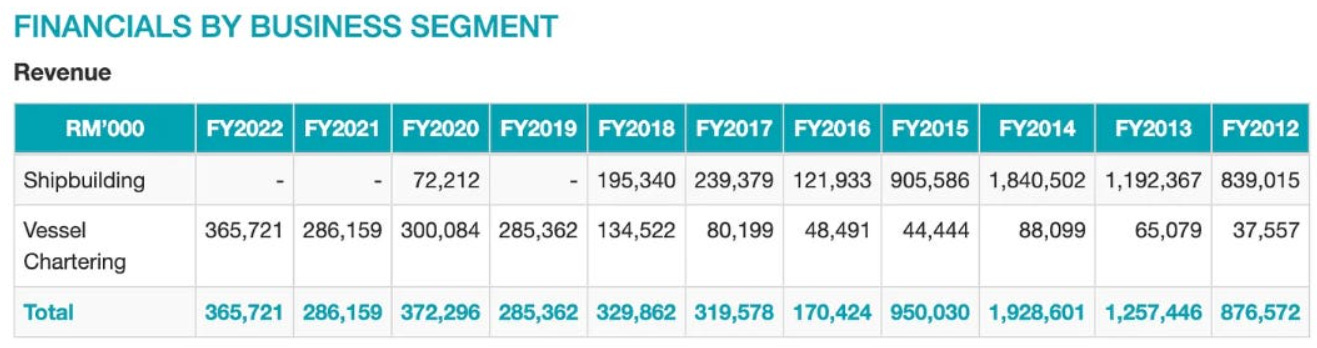

Loading the boat with Nam Cheong - 1MZ 🔱 (SGX)

Nam Cheong Ltd appears to be a company with some incredible asymmetric opportunity at the moment. I bought a small tranche in at <0.20c, and then while I mulled over the thesis and how much more I should sell & redeploy, the stock price shot up to >0.30c within a week, as the market re-rated the value of the company.

A similar thing happened to me in late 2020 with uranium, I moved too slow (talked about how this is a problem of mine here), and missed out on the most important asymmetrical gains.

Subscribe to

& Substacks to see detailed write-ups on the 1MZ thesis; You should seek out people such as and countless others on Substack to use as your own personal analysts - My opinion and DYOR.Super Simplified 1MZ thesis is essentially:

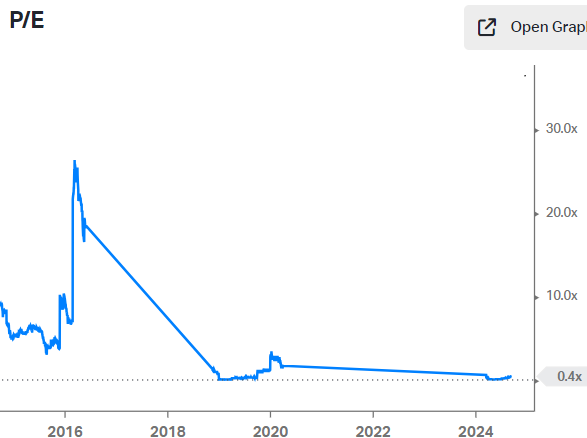

Incredibly cheap on a tangible assets basis (P/E ratio super low!).

Been through chapter 11, TWICE (write-off of huge amount of debt).

Earnings are increasing and debt being paid down.

Zero earnings from its shipyard, huge future potential.

Large OSV fleet of some 32 modern vessels.

Management with significant personal ownership.

General global oil bull market thesis - and the offshore driller thesis (will not re-hash here).

And here are a bunch more articles provided by John, subscriber to

& Substacks (thanks John).NAM CHEONG: It plunged on re-listing in March. But the stock is now up 50% in 2 weeks

$100 billion potential: Flurry of FIDs for Asian offshore gas projects

Multiple oil & gas firms ink deals for 12 fields offshore Malaysia

I am now in at just under 200,000 shares of Nam Cheong, a heavily overweight 26% position. Admittedly I have fomo’ed in significantly at around 0.30/0.33c.

My base case (based on the detailed thesis outlined by the accounts mentioned above) is; even at worst, should the company and share price underperform over the next few years and stay close to/sub $1 SGD, this will still hold ~>$200k AUD of value (again getting in on asymmetry, the company is so incredibly cheap at these prices). Upside potential asymmetry meanwhile is huge. I am ok with this level of risk.

Uranium ☢️ 💀

I won’t mention much (too many emotional accounts on U-Twit now & I don’t need to be another one), if you are a uranium investor, you know the pain. Sentiment continues to remain in the toilet while fundamentals are more bullish than ever. But…

Great time to enter the trade if you have been on the fence, although the real asymmetry has gone.

For any that missed the KAP production cut news, The Pale Blue Dot did another great write up (below). This production cut provided a brief reprieve in share prices before downward action continued.

The uranium market is still (unfortunately) almost exclusively driven by retail investment/sentiment, which tends to focus almost solely on spot price 📉. It is hard to believe Boss Energy (for example) was at 6 bucks in May, and at time of writing at $2.70 (with probably more red ahead).

All we can do is forget about our holdings, and think to where this will be in Q1 2025 and beyond. Fair to say it will be an interesting 6 months going forward!

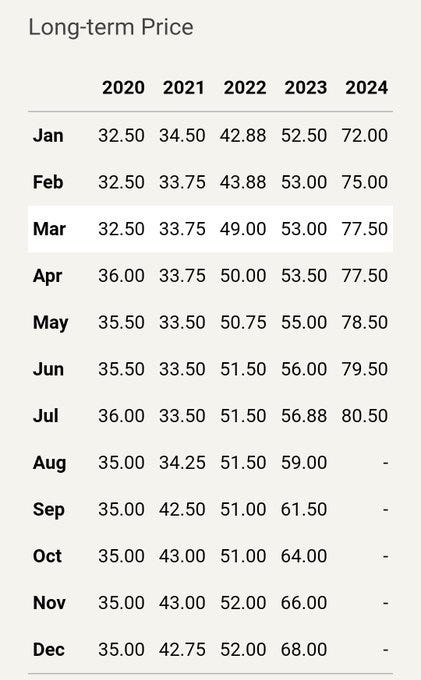

The last thing I will mention is the LT Spot of Uranium 👇 Does this look like a commodity in oversupply/long-term bear market? 📈

2 - Life Update ✈️

Zihuatanejo/Ixtapa

As mentioned last month, I was craving some coastline after a couple of months in Los Andes in Peru, and then in Central Mexico. I was keen to head to the Pacific Coast near Guadalajara, but I’d already spent over a month in Nayarit & Sayulita in 2023, so wanted something different.

Ended up on a 13 hour bus from Guadalajara to Zihuatanejo/Ixtapa. My gf flew in from CDMX and we spent a week in full holiday mode.

This was a beautiful tropical section of the Pacific Coastline that reminded me a lot of parts of Indonesia/Thailand, although unlike Puerto Vallarta, Sayulita and Escondido, there were (almost) no gringos. This is mostly a domestic tourism spot for Mexicans, with a small airport and direct daily flights to CDMX.

When I heard there were crocodiles in the streams here, I thought ‘oh sure, they probably see one once a month’… Ohh no 👇I would not want to own a small dog in Ixtapa..

This same day we saw two crocs fighting in the fully equipped marina, only in Mexico!

Troncones/Mahajua

About 40 minutes up the coast from Ixtapa, Troncones is a sleepy beachside spot, that is much more off the map, but also more catered to western tourists (consists of about 1km of Bali style private villas along the coast).

We jumped in a 10 peso collectivo, which took us to the highway turn-off, and then hitch-hiked our way down to the coast in the back of a farmers ute. My gf is Mexicana and didn’t blink an eye, but fair to say I probably would not have done this by myself in this part of Mexico (Guerrero & Michoacán are meant to be narco hotspots currently)… 😂

In hindsight, I would have come here for the whole week but had no idea when booking. It’s super quiet and there are two really chill left-hand point breaks that seemed to be working even on a small swell (the video upload quality on Substack seems to be really shit unfortunately..).

Sadly, we only came for one night, so I didn’t get time to have a paddle🏄♂️ . Interestingly there is no direct bus from Ixtapa to Troncones (it must only be more for richer families/Gringos on tourist packages).

View from our villa was was bloody epic too ☝️

If you are after some quiet waves, beautiful sunsets and basically have a beachfront to yourself (basically only families), I’d highly recommend this little stretch of the Pacific Coastline. Beware it is full tropical humidity though (again it reminded me of Indonesian wet season).

Back to CDMX

Back in Mexico City now, my girl landed a new gig working on a Netflix film up until May 2025. Currently staying in a house her family owns in Colonia del Valle (The Valley), in the southern part of the megacity. This barrio/neighbourhood is really bloody nice, and a good example of middle-upper class Mexico (but certainly not like the ‘super rich’ areas in Lomas, in the north-western part).

I say this as there are literally zero gringos/english speakers here, unlike in Condesa/Roma, where I have spent most of my time previously (I really need to step up my dogshit Spanish now.. 😢).

We are 5 minute walk from 3 enormous supermarkets that are actually better quality than Australian Woolies/Coles, a giant USA style mall & lots of great coffee spots.

Finally Found a Decent Gym with a Sauna in LatAm..

This turned into a rant - apologies.

This might sound silly, but as any seasoned travellers of LatAm (I am not claiming to be one) know, gyms and gym culture in Latin America SUCK. The caveat here is I am talking outside of the super touristy spots like a Cancun/Playa del Carmen etc (this is not real LatAm, sorry Americans!).

Could write a whole post on this, but coming from Australia (I am sure it is the same in the USA), gyms are usually pretty epic (and surprisingly cheap, one of the few things).

LatAm gyms tend to be small, absolutely rammed with people at all hours and the worst is the Latinos that will tap you on the shoulder while you are mid-exercise and ask to work in with you (just fucking wait for 3 minutes!). Latinos also seem to love flexing in the mirror in front of everyone 🤷♂️.

This is the same in every country I have visited. To be fair, I am the one visiting their culture, so jokes on me really. Also, before anyone suggests SmartFit, I have signed on to monthly plans with SmartFit in 4 different countries, and the service is absolutely shocking, the trainers are annoying and have rules for everything, can’t get on equipment due to so many people, & I have had to block my card payments from them as they keep trying to deduct payments even though I only signed a 1 month contract (my gf even checked and it actually wasn’t due to my shitty Spanish).

Anyway, I found a half decent gym 5 minutes from our place in Del Valle👆. It was $1050 pesos for two months ($53 USD/$78 AUD), it isn’t too crowded outside of peak hour, includes classes AND it has a sauna (I miss the sauna a lot after spending years in Bali, where every gym has one)!

It is the little things in life that make me happy, decent gyms are one of them 🙂.

Hiking in Parque Los Dinamos

& lastly, we went hiking in this giant gorge (photos don’t do it justice), only about a 10 minute drive out of the city (without traffic), which honestly blew my mind. The whole Mexico Valley must have looked like something out of Jurassic Park before Cortez & the Spanish arrived.

Would recommend you come visit if you are spending more than a few weeks in CDMX (again no gringos come out here), but do NOT come on a Sunday, as half of Mexico City was hiking the canyon with their doggos.

3 - Paraguay Residency Paid & Flights Booked; Contemplating Panamanian Corporation 🤔

Paraguay

Paraguay Residency has been paid off, and flights booked to Asuncion (the capital) for the start of October. Feels good to finally be making some progress with internationalisation.

Planning on rendezvousing with

for a week or so in Asuncion as we both (hopefully) get our residencies sorted. Looks like there are some decent gyms & saunas in Asuncion, and lots of cheap steaks - looking forward to it.Will continue to write about this each month for any of those interested in getting this residency in the future (my advice would be do not wait too long, governments frequently make these harder to get).

I am not 100% sure exactly how I will use my Paraguayan residency in the future, whether it be used to link a stockbroking portfolio, use as a tax domicile, or simply as a backpocket plan B country. I think the latter will be most likely; once you upgrade your Temporary Residency to Permanent Residency (after 2 years), you have it forever - an awesome call-option and somewhere to go if shit hits the fan again like during covid. And while Paraguay is a poorer nation, its trajectory economically looks bright over the longer term 📈 (talk about this in another post).

As I mentioned last month, I have used Nicole from Work, Wealth & Travel (WWT) for my residency, and the process has been great so far. The prices from most people offering their services all seem very similar, at around the $2.5 - $3k USD mark. Some people out there are offering the residency at >$4k USD (I’ve seen one for USD $7k!). I’d recommend shopping around if you come across these guys as they are basically fleecing people who probably don’t have much experience in travelling etc.

I’ll write a separate post on all this when I have boots on the ground in October, to save this from becoming more of an essay.

Panamanian Corporation Formation & Residency

Again I’ll save the bulk of this for another post - but after talking with WWT about the complexities of overseas company formation for Aussies, I have been looking into the benefits of setting up a Panama Corp, though I probably won’t be in a position to do so until Q2 2025 (hopefully they don’t change the rules).

Why Panama Corp?

Protection for yourself and your business, from both your home government and from being sued/bankruptcy etc. Can be layered with a US LLC Corp as a ‘passthrough entity’ to add another layer of protection (I am still learning the jargon words here..).

Zero tax on all income earned from outside of Panama.

Can be used to own a stockbroking account such as IB (also crypto etc), and also to own your own business, of which you are an employee (of your own company).

Instant access to Panamanian banking. My goal is to start trying to diversify my overseas banking options away from Australia in the coming years. Panamanian banking is top tier in the Americas, but apparently shitty in Europe.

No physical presence required - besides the initial setup and a visit every 2 years to update your residency.

Once you have your Panama Corp setup you can apply for Temporary Residency (Friendly Nations Visa), which as with Paraguay, can be updated to Permanent Residency after 2 years, which again you have forever. You do not need to live in Panama at all for residency, only needing to visit once every 2 years for 1 day (pretty amazing IMO).

I’ll go into this more on another post, but full transparency - the best pricing options/package I’ve found on this so far was through The Wandering Investor’s contact, which was significantly more competitive than WWT’s prices.

$11 grand USD is a LOT on money for little old me at the moment (every penny is in the portfolio..), but hopefully going into next year I will be in a position to throw around some money. I personally think it is a great investment for your future self, and the fact that you get residency in Panama too, is appealing.

4 - Plans for September🧳

Basically, not much!

Essentially just back into a routine here in CDMX

But first, a quick rant about Twitter..

As much as I’m thankful for Elon buying woke Twitter a few years back (and propelling us towards interstellar travel in his space time), I find myself using X/Twitter less and less these days, usually trying to limit it to a quick pit-stop on the loo 🚽.

While it is great for uncensored developing news/sharing (Trump assassination attempt perfect example), for general back and forth and value sharing, it seems now to mostly be an algorithm encouraged clout-chasing cesspool (many people posting vacuous nonsense 10+ times daily, everyday).

I totally understand that if you want to see everything, you have to see the awful things, that is the nature of free speech. It is just unfortunate that the accounts I enjoy the most tend to be the ones only posting a few times a week (usually older gentleman), but these never pop up on my feed.. (rant over).

Anyway - this post from Lawrence King (great follow, and I’m not even into high ticket sales) resonated with me in terms of where I am heading to in life right now - coming full circle on why I am looking forward to a boring routine for a while.

At 34 I still love travelling and not fully settling down (yet), but I have come to realise how important it is to try to have some form of base, and then (ideally) do smaller trips from there. Part of the evolution of your 30s I guess..

So what actually are the plans for September..

Looking forward to a boring routine for the next month; back into the gym 4/5x per week & starting to work on practising due diligence on buying websites.

👆Wtf is due diligence on websites? This is something I will elaborate more on in the future, but it is part of my long term plan for starting my own business portfolio and location independent cashflow in the future.

I have mentioned it briefly before, but I plan to start to eventually scale out of uranium & use the capital to buy domain names that have been running as profitable businesses for a number of years, and use this as my income 🤞.

$100 grand invested can essentially ‘buy’ you and income of $3k to $4k per month (if you find a good deal), which when you think about it in an insanely good ROI. This is my plan for long term financial freedom, but will talk about it more next year.

5 - Valuable Content Consumed This Month 🥸

on ‘Neotoddlerism’ - a hilariously articulate piece examining the recent extreme activism seen on both the left and the right.

The ease with which dramatic behaviour gets attention online has convinced many political activists that a better world doesn’t require years of patient work, only a sufficient quantity of drama.

Many activists on both the Left and Right now hope to bring about their ideal world the same way a spoiled brat acquires a toy they’ve been denied: by being as loud and hysterical as possible. This is neotoddlerism: the view that utopia can be achieved by acting like a three-year old. -

.

What if Germany had invested in nuclear power?

Link in the title. If government covid lockdowns were the stupidest thing humanity has done in my lifetime, the Germany government literally blowing up their world-class nuclear reactors would have to be a close second.

on the brain drain from The West

It isn’t always just about tax breaks and the highest-speed internet. Quality of life is becoming increasingly important for many, and the West, in many places, is turning into a dump that treats its native populations like feudal serfs. Why stick around if you do not have to and be abused by the political class that hates you?

This is a trend to keep on your radar screen. Capital, including the human type, always goes where it is treated best.

This is part in parcel of why I want to have a crack at getting at least two or three residencies in the next eighteen months; future legal call options on somewhere to go (if shit starts to hit the fan again). And somewhere to live indefinitely without a visa.

If this seems extreme to you, then I would point to rapid acceleration of the decline of The UK & Ireland in the past 6 months, as just one pertinent example (

recently wrote about the Orwellian free-speech internet crackdowns in the UK).Kuppy wrote an interesting piece on the same issue

Why pay more for less?? Why pay when your country no longer feels like your country?? Why pay when you disagree with the current trajectory?? Why support them when they hate you?? Why not leave?? What happens when your friends are also leaving??

I see this as a Mega-Trend, especially as the inevitability of exit taxes and currency controls dawns on the 0.1%, further accelerating the trend.

I am certainly not claiming to be in the 0.1% (I wish 😄); but would argue it is the middle class in countries like Australia and The UK that tend to be ‘milked’ & suffer the hardest.

If someone with a networth of $50 million pays $24 million in taxes, and then say $5 or $10 million in some form of wealth/exit tax, they are still 1000x better off than someone in the middle class earning $100k with a mortgage and 2 kids (who has almost zero optionality).

Goehring & Rozencwajg’s Q2 Natural Resource Market Commentary - Coal Demand shows no sign of peaking

(For the next time the average person on the street tells you coal is going away in the next 20 years, or thinks you’re insane for investing in coal mining companies).

“And yet, despite all the solar panels, all the windmills, the electric vehicles, and the government incentive to go green, the world has never used as much coal as it’s burning this year.”

The release of the 2024 Energy Institute (formerly B.P.) Statistical Review has underscored a point we have long emphasized—despite significant investments in renewable energies, global coal consumption shows no signs of peaking.

The report reveals that global consumption hit record highs last year, although consumption in North America and Europe has declined for the past 15 years, coal usage in Asian economies like China, India, and Vietnam continues to show strong growth. China’s coal consumption in 2023 increased by nearly 5%, India’s by almost 10%, and Vietnam’s by an impressive 22%.

GoRozen again, reviewing the concept of EROI - Energy Return On Investment

Great read if you’re not familiar with the concept (link in title); and something it seems no politicians anywhere in the world have a grasp of.

The total energy required to power an electric vehicle using renewable sources for a distance of 100 miles significantly exceeds that of an internal combustion engine. 👈 What percentage of the population would understand this?

on energy demand growth globally.

Seems I share an article from

’s Substack every month. This article comes as no surprise for us as energy investors, but it is super interesting update.That’s all for August - Appreciate it if you made it this far!

I have 10+ draft pieces half written on Substack on random things on my mind, that you may find interesting. I hope to hit publish in the next few months.

Hit the ♡ button, helps give me feedback.

Cheers ! 🍻

Tom - VanDiemen 🦘

Thanks for the shout outs re Paraguayan residency. The life updates are great. A few years ago I travelled to Spain and actually found it quite difficult even though I'd tried to learn Spanish - I could never understand the replies because of how fast people spoke. And I found I craved English.

Still, being able to say "thank you " and "please" goes a long way in my book

Love seeing the aggregation of the interesting things you've recently read - keep it up! Enjoy your chill time 🤟