April '24 Networth & Life Update📉$666k

Sharing these updates to stay accountable, prove that you don't need to follow societal norms to be financially 'successful', & to share where I am at currently in El Mundo 🌎

Currently writing a post on My Investment Philosophy, which will go into everything in more detail, including what I invest in, and why. Essentially who I follow/read to help foster my investments and way of thinking about wealth & the markets. Hope to post in May sometime.

Wrote an intro on who the hell I am here if anyone is interested.

This is the first in what I hope to be monthly life & networth updates

Caveats -

Only started tracking my networth in 2020 (unfortunately).

Had $0 in 2016 at age 26 (never been given any $$).

Never been in debt. No kids or dependents (yet).

All shown in AUD (the ‘Pacific Peso’ - plan to try earn USD in 2025..).

Not a digital nomad. Not had a salary since June 2023. Saved hard, built a decent stock portfolio and left Australia post covid to start a new chapter.

Sharing to hold myself accountable, share the financial journey over my 30s, and motivate to keep growing. Certainly do not think I am rich (the opposite!).

Financial goals for the next 2 -3 years:

1) Convert uranium stockmarket gains into online assets that yield cashflow (currently no real cashflow - living cheaply in LatAm while selling down some shares).

2) Start breaking tax ties with Australia.

Don’t compare yourself to me. Some people reading this will be 10 years younger with 5x the networth, others 10 years my senior and for whatever reason only starting their financial journey now. It is all subjective - it’s your journey, who cares.

Why share this?

What's measured is managed. For whatever reason I have always liked to vaguely track my networth. It helped to give me a sense of purpose and to justify working all those years in mining (I genuinely enjoyed my career quite a lot, but it was certainly not a passion..); I also like to think that by tracking it I am helping to set up life for future Tom, in his 40s & 50s 🤷♂️. Finally, this Substack writing is basically just cathartic journaling, really don’t care if it is read or what people think!

I am generally a private person - unsure if sharing this is a good idea, but hopefully some like-minded people may find it interesting. I thought about not posting it and then reflected: Stop taking life so seriously. In 2 or 3 generations, no one will even remember your name. Life is really short, somewhat ridiculous and guaranteed to end sooner or later ☺️

1 - Networth Update 🪙

2 - Superannuation 📊

3 - Life Update ✈️

4 - Forced Sale of MMA Offshore 😒 (where to allocate $93k..?)

5 - Wrap up & Plans for May

Networth Update 💰 $666,072

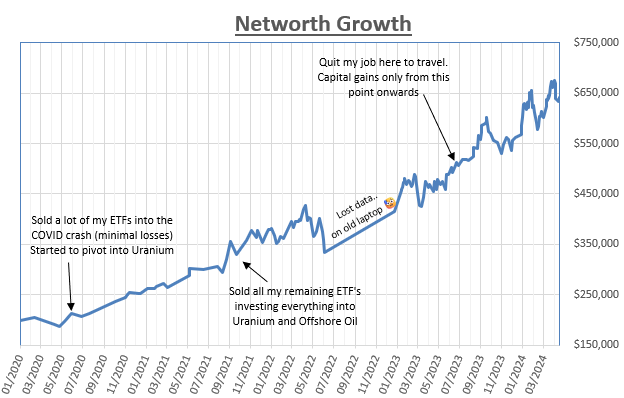

Overall for April; had a small gain of $2,220 since the start of the month (so basically didn't move). A brief spike to $676,093 on the 12th of April is the highest paper wealth I’ve had. It looked like Uranium was going for a run again at the end of April, and then on the last day of the month, the US Congress finally approved the bill to ban Russian uranium imports.

Yesterday, after market close, the US Senate approved a bill to ban Russian uranium imports. The bill will now head to President Biden for signing and to become law. 90 days after signing, no further US deliveries of Russian enriched uranium (EUP) will be permitted (from existing contracts, or new contracts), unless a waiver is granted.

The ban will have important implications for the uranium market in the near and long term, and is overall bullish for spot and LT prices and Western uranium stocks.

This is potentially super bullish news for uranium investors, and I expect a run in stocks at least in the first week of May. Uranium makes up >65% of my portfolio (more on who I follow for my investing philosophy in a future post), hence the volatility you see in the below chart.

It is important to acknowledge that stomaching the volatility associated with this style of investing is not conducive for most people given their psychology or life situation (better off in ETFs or dare I say, property). Accepting volatility is par the course with asymmetrical investing, more in a future post.

Superannuation

Also currently writing a post on Superannuation (retirement funds such as 401k) and why I don’t think they are a good idea for the entrepreneur or financial contrarian. Superannuation and retirement funds are applicable if you work an 8 to 6 job, plan to do so well into your 60’s and never leave your home country, but are a silly idea for the small business owner/entrepreneur/expat.

Networth excluding Superannuation is a more accurate reflection of networth, which puts it at: $530,500 (USD $347k😒).

Will look at breaking down the portfolio further in the future with tickers and average weightings. Currently have a big chunk of about $53k (soon to be 93k) cash sitting in the bank, from the forced sale of stock MMA (more below). Currently unable to transfer to my IB account due to issues with signing into the account from overseas… 😣 I almost never have any cash as I see SO much opportunity in stock investments at the moment.

Life Update 🧳

After travelling for about 10 months already, I arrived in Lima, Peru 🦙 at the start of April after spending about 6 weeks in Central America (Nicaragua, Costa Rica & Panama). Have been parked up in Miraflores (the affluent ‘bubble’ suburb) doing not much for the past month. Lima (at least Miraflores & Barranco) has thoroughly exceeded my expectations, and I am genuinely surprised I don’t hear more about Lima from LatAm Twitter (though don’t have much in common with that crowd..).

Was not a huge fan of my time in Central America, given how I like to travel at this stage of my life. 🇳🇮 Nicaragua is more suited to backpackers and people on a short surf trip; 🇨🇷 Costa Rica is beautiful but almost more expensive than Australia (not why I came to Latin America!), it is more suited for Eat-Pray-Love type western travellers, backpackers and young families with money (would travel here with kids if I was rich); 🇵🇦 Panama City was cool for a week to get some big city vibes, but I had an awful week in Bocas Del Toro (whole other story), which is bloody beautiful (almost as nice as South East Asia) but again more a backpacker vibe and not cheap (USD in Panama).

Above; 5 min walk from Miraflores Airbnb, epic shopping centre with everything, western shops, cinema and restaurants. Weather has been epic; Lima (super close to equator) has a super bizarre mirco-climate, where cold oceanic water coming up from Chile hits the hot dry desert equatorial air, keeping the place relatively cool, but often producing fog (in winter).

Do NOT come to Lima in the winter time, the city is covered in fog for about 7 months, starting in May/June. April has been great though.

Super lazy month, just getting back into some surfing, gym and exploring the cafes of Barranco (the barrio next to Miraflores) and gorging myself on Peruvian cuisine. Most of the seasoned LatAm travel crowd typically espouse that Mexico & Peru have the best food in LatAm (With Argentina an equal third for the asado culture). Mexico definitely beats Peru on street food, but seafood (at least in Lima) is far better in Peru, its bloody hard to compare the two!

Meeting up with an Aussie mate who lives in Buenos Aires and heading to the Andes for some big hikes in May 🏔️.

Forced Sale of MMA Offshore 📈

A TraderFerg recommendation from a few years ago, this stock has been an incredible performer, and one I was expecting to hold for the next few years while it ground higher. The original 15k investment went to about $94k AUD in less than three years (~490% return), and (as per the article above) was acquired by a private Singaporean company for $2.60 a share (it will be later this year). This is incredibly frustrating, and a terrible deal for long-term shareholders, as the stock would have likely ground away to well over $5 over the next few years, as the oil bull market gains more steam. A good investing lesson though, as I have a number of other companies in the portfolio performing well that are at risk of takeovers in the next few years.

$93k Cash - Where to allocate?

$10k will be parked to help pay tax at the EOFY and to have some money for when I plan to return to Tasmania to see my parents for Christmas.

Another $10k used as travel cash for 2024 (I have been selling shipping stocks that have traded sideways to fund 2024 travelling up until now).

Leaves about $70 - 75k ish - which will be sent to Interactive Brokers (I have two broker accounts). This will probably be used to invest into more offshore drillers, and to start building long-term positions in coal mining companies (again more in future posts, but subscribe to TraderFerg would be my recommendation). I am currently thinking of something like:

10k into RIG - Transocean (boosting to about 25k position).

5k into BORR - Borr Drilling Ltd (boosting position to 12k).

5/10k into MCE - Matrix Composites & Engineering Ltd (start position).

10k into WHC - Whitehaven Coal (boosting position to 20k ish).

10k into YAL - Yancoal (starter position, insane dividend).

5k into BTU - Peabody (boosting to 12k ish position).

Remaining 15k-ish unsure if to allocate to more coal positions, more offshore, OR potentially a position in UEC - Uranium Energy Corp, so I can start copy-trading my mate GeologoTrader on some options trading for income, something I should have got into last year (too lazy).

Wrap Up & Plan for May 2024

At time of writing, only have a few days left in Lima. Me and my mate are heading to the Peruvian mountain city of Huaraz, where we plan to base up for a few days to acclimatise (Huaraz is 3,052 m - 10,013 ft), before heading off on one of the famous one-day treks (maybe Laguna 69), back to Huaraz for a few more days, and then embarking on the 8 to 11 day monster HuayHash Trek (bit nervous about this one!).

Hoping to see a month of heavy lifting from the uranium side of the portfolio this month, however in saying that I will probably curse it and get smacked.

If you made it this far pls hit the like button ❤️

Thanks for reading!

Tom - Van Diemen

Have a look at tin (AFM or MLX) if you got some cash left over. 😉

Yeah man, lived for 7 years in Santiago Chile and visited Lima once.... in the middle of the foggy sunless winter. Still, the Baranco was nice and local pisco sour and ceviche was awesome. In fact, the famous saying we had among expats in Chile -- the best Chilean food is... Peruvian. Chilenos didn't enjoy it )))